Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

The September Chicago Fed National Activity Index (CFNAI)(pdf) updated as of September 27, 2010:

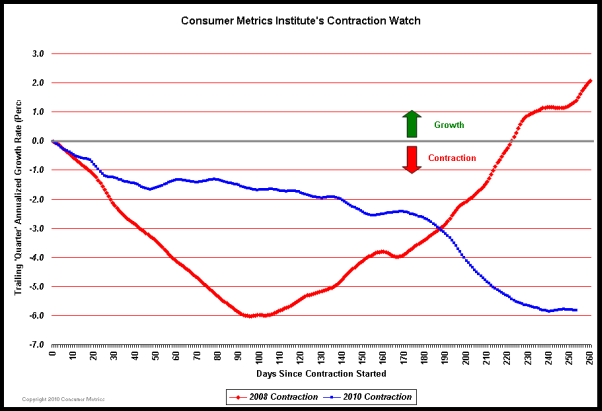

The Consumer Metrics Institute Contraction Watch:

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from August 31, 2010:

“The August update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, slowing to 1.3% in November through January. The end of government stimulus spending and inventory buildup combined with continuing high unemployment, a weak housing market, tight credit and high debt are behind the slowdown.”

The ECRI WLI (Weekly Leading Index):

As of 9/17/10 the WLI was at 122.2 and the WLI, Gr. was at -8.7%. A chart of the growth rates of the Weekly Leading and Weekly Coincident Indexes:

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of August 31 was at 43.2, as seen below:

An excerpt from the August 31 Press Release:

“The ESI’s stability during recent months belies some of the recent weakness seen in other sentiment surveys and suggests that the underlying momentum of the U.S. economy, including employment, remains positive,” Dow Jones Newswires “Money Talks” Columnist Alen Mattich said. “However, the ESI remains well below the 50-plus levels that characterize normal expansions. This relative weakness suggests it would take little to push the economy back into recessionary conditions.”

The ESI is determined using an economic sentiment analysis algorithm to review news coverage in 15 daily newspapers across the U.S.”

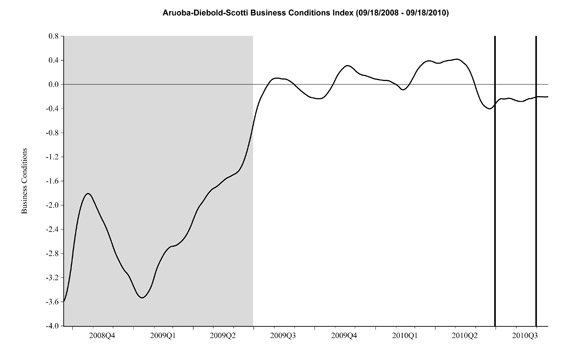

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, updated through 9-18-10:

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the September 23 release, the LEI was at 110.2 and the CEI was at 101.3 in August.

An excerpt from the August 23, 2010 Press Release:

“Says Ken Goldstein, economist at The Conference Board: “While the recession officially ended in June 2009, the recent pace of growth has been disappointingly slow, fueling concern that the economic recovery could fade and the U.S. could slide back into recession. However, latest data from the U.S. LEI suggests little change in economic conditions over the next few months. Expect more of the same – a weak economy with little forward momentum through 2010 and early 2011.”

“New Financial Conditions Index”

I wrote a post concerning this index on 3/10/10. There is currently no updated value available.

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

SPX at 1148.67 as this post is written