On December 20, 2023 The CFO Survey was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In the CFO Survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

Revenue and employment expectations for 2024 remained solid.

- Median expected employment growth stands at 2.7 percent for 2024 — up from 2.2 percent in 2023.

- Median revenue growth is expected to remain steady at 5 percent for 2024.

- Median price and unit cost growth are expected to slow from 5 percent this year to 3 percent and 4 percent, respectively, in 2024.

also:

Still, respondents’ average expectation for GDP growth over the next four quarters is 1.7 percent, up from 1.3 percent in last quarter’s survey. “The probability that firms assigned to a decline in economic activity has fallen considerably since the beginning of the year,” says Waddell, “which, combined with the increase in optimism, is a positive development for the business outlook for 2024.”

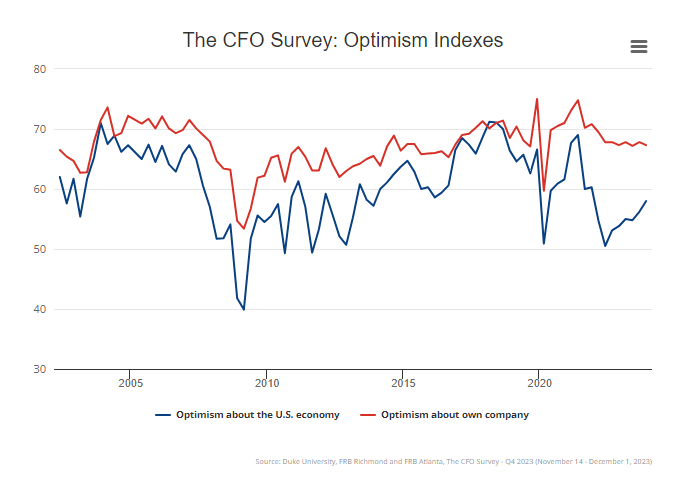

The CFO Survey contains an Optimism Index chart, with the blue line showing U.S. Optimism (with regard to the economy) at 58.0, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4770.30 as this post is written