On October 14, 2021 the latest CFO Survey (formerly called the “Duke/CFO Global Business Outlook”) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

Three-fourths of U.S. CFOs express difficulty hiring, leading them to increase wages, according to The CFO Survey, a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta. Most CFOs also indicate in the third-quarter survey that their firms are experiencing supply chain disruptions that are expected to last well into 2022.

When asked whether they are currently experiencing disruptions in their supply chains, three-quarters of firms report disruptions, including production delays, shipping delays, reduced availability of materials, and increased materials prices. Large firms are more likely than small firms to take action to adjust their supply chains, such as holding more inventory, diversifying or reconfiguring supply chains, moving production closer to the U.S., or changing shipping logistics. Small firms note less “room to maneuver” and are more likely to report waiting for supply chain issues to resolve themselves.

For the panel as a whole, only about 10 percent of respondents anticipate these supply chain difficulties will resolve by the end of this year. Most respondents anticipate these issues will not resolve until the second half of 2022 or later.

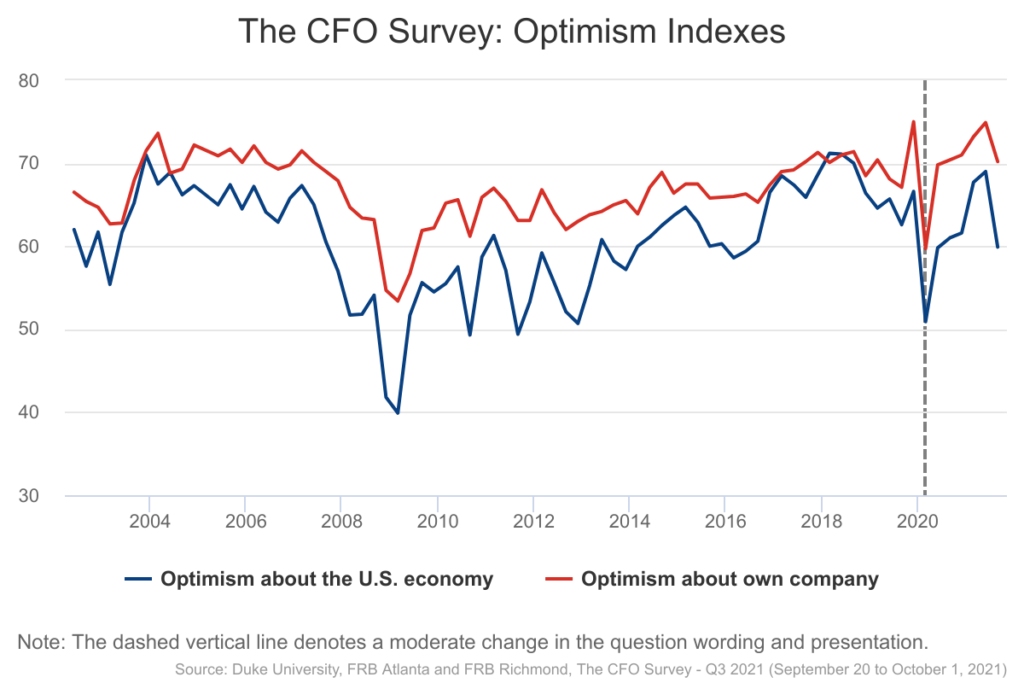

This CFO Survey contains an Optimism Index chart, with the blue line showing U.S. Optimism (with regard to the economy) at 59.9, as seen below:

[Note: The dashed vertical line denotes a moderate change in the question wording and presentation. Please see The CFO Survey Methodology for further information.]

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4433.73 as this post is written