On September 18, 2019 the September 2019 Duke/CFO Global Business Outlook was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

The CFO Optimism Index, which historically has been an accurate predictor of hiring and GDP growth, fell this quarter. Fifty-five percent of CFOs have become more pessimistic compared to the 2nd quarter this year, far outnumbering the 12 percent who say they have become more optimistic.

also:

More than half (53 percent) of U.S. CFOs believe that the U.S. will be in an economic recession by the third quarter of 2020, and 67 percent predict a recession by the end of 2020.

also:

Economic uncertainty has displaced difficulty hiring and retaining qualified employees as the top concern among U.S. CFOs. Recruiting and retaining talent remains the second-most pressing concern. Other prominent concerns include government policies, data security and the rising cost of employee benefits.

also:

Business spending is often weak in the face of economic uncertainty, which is what the survey finds in the U.S., with a less than 1 percent increase in capital spending expected over the next 12 months. This is the lowest growth since September 2016, and the second-lowest growth since December 2009.

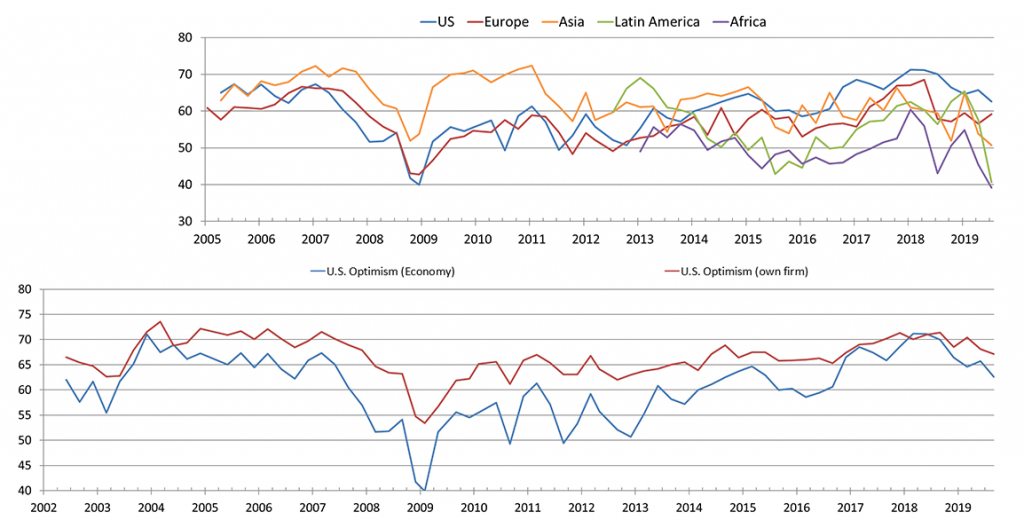

The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 63, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3006.73 as this post is written