On March 7, 2018 the March 2018 Duke/CFO Global Business Outlook was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO survey, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

Forty-four percent of U.S. companies plan to increase wages more than they would have without tax reform. Thirty-eight percent plan to increase employment and 36 percent will increase domestic investment. Thirty-one percent will increase cash holdings. Among companies with defined benefit pensions, 28 percent will increase pension contributions.

also:

Due to tax reform, the effective (or average) tax rate for U.S. companies is expected to fall by about 5 percent, from 24 percent to 18.8 percent.

also:

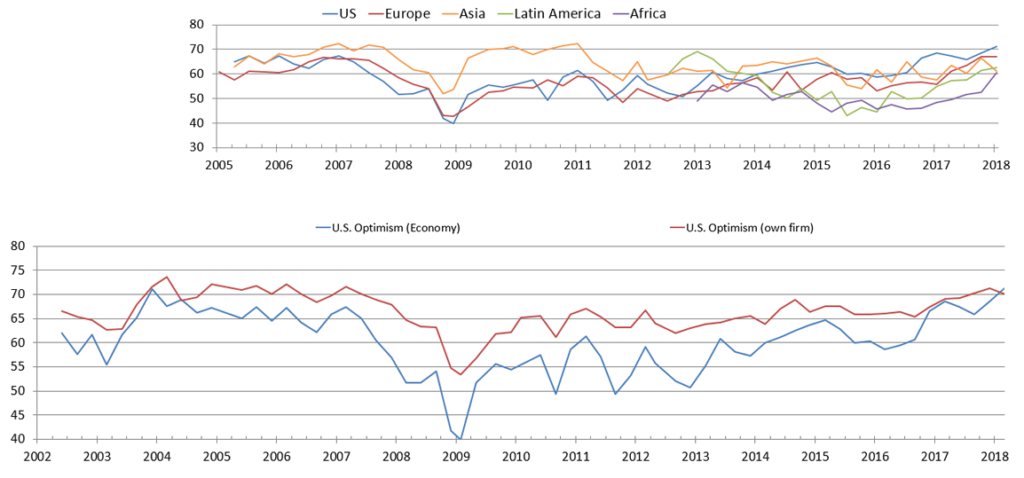

The Optimism Index in the U.S. increased to 71 on a 100-point scale this quarter, an all-time high.

“The extremely high level of business optimism is tied to the recently passed corporate tax reform,” Graham said. “Our analysis of past results shows the CFO Optimism Index is an accurate predictor of future economic growth and hiring, therefore 2018 looks to be a very promising year.”

Optimism is up around the world, anticipating strong global economic conditions.

also:

The proportion of firms indicating they are having difficulty hiring and retaining qualified employees remains at a two-decade high, with 45 percent of CFOs calling it a top concern, up from 43 percent last quarter. The median U.S. firm says it plans to increase employment by a median 3 percent in 2018.

“The tight labor market continues to put upward pressure on wages,” said Chris Schmidt, senior editor at CFO Research. “Wage inflation is now listed near the top half dozen concerns of U.S. CFOs.”

The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 71, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2735.50 as this post is written