On September 11 the September Duke/CFO Magazine Global Business Outlook Survey (pdf) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey, I found the following to be notable excerpts:

U.S. CFOs are growing more pessimistic about the American economy, with hiring and spending plans significantly weakening since last quarter. Finance chiefs say that their business spending plans are not sensitive to moderate changes in interest rates, suggesting that there is little that the Federal Reserve can do to stimulate investment at this time. In addition, CFO concerns about Europe also have increased in the past three months.

also:

The Federal Reserve’s attempts to reduce interest rates will have little impact on corporate investment, say CFOs. Ninety-one percent of firms say their spending plans would not change if interest rates were to fall by 1 percentage point. Eighty-four percent say a 2 percent rate reduction would not affect their spending plans.

also:

Harvey called it “amazing that all the focus is on interest rates when they are already at 50-year lows. We also asked about the impact of increased borrowing costs. Nearly 94 percent of CFOs would make no change in their investment plans if borrowing rates jumped up by 1 percent.

also:

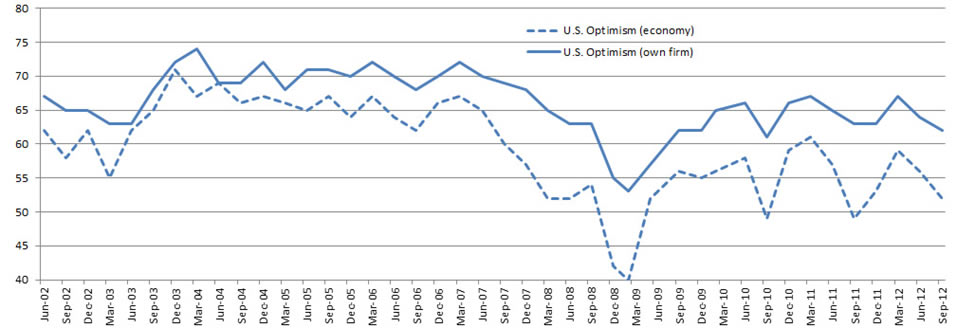

Forty-four percent of U.S. CFOs say that have become more pessimistic about the economy, twice as many as the 22 percent that say they have become more optimistic. The Optimism Index decreased to 52 (on a scale from 0 to 100), down from 56 last quarter and 59 in the spring.

also:

U.S. businesses list a number of concerns that have reduced their optimism, including the ability to maintain profit margins, the cost of health care, difficulty in attracting and retaining qualified employees, and maintaining employee morale. The list of external concerns is topped by weak demand for products, federal government policies, intense price pressure and competition, and global economic instability.

also:

Corporate plans for earnings, spending and hiring all softened this quarter. Earnings for public U.S. firms are expected to increase 6 percent over the next year.

also:

Hiring is expected to increase by 1.5 percent in the next year, down from greater than 2 percent growth reported in the last two surveys.

The CFO survey contains the Optimism Index chart, showing U.S. Optimism (with regard to the economy) at 52, as seen below:

–

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed various aspects of this, and the importance of these predictions, in the July 9 2010 post titled “The Business Environment”.

(past posts on CEO and CFO Surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1463.37 as this post is written