Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

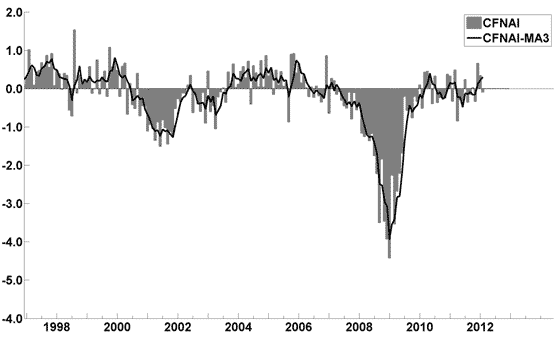

The March Chicago Fed National Activity Index (CFNAI)(pdf) updated as of March 26, 2012:

–

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the March 22 update titled “Index forecasts weaker growth” :

The February update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, increasing to 2.5% in March and April and then slowing to 2.1% in July. While employment, housing (mostly the multifamily sector) and consumer spending are slowly recovering, concerns about the Eurozone and world growth continue.

–

The ECRI WLI (Weekly Leading Index):

As of 3/23/12 the WLI was at 125.7 and the WLI, Gr. was at -.4%.

A chart of the WLI, Gr. since 2000, from Doug Short’s blog of March 23 titled “ECRI Indicators Improve, But Beware the ‘Yo-Yo Years” :

–

The Dow Jones ESI (Economic Sentiment Indicator):

no current value available

–

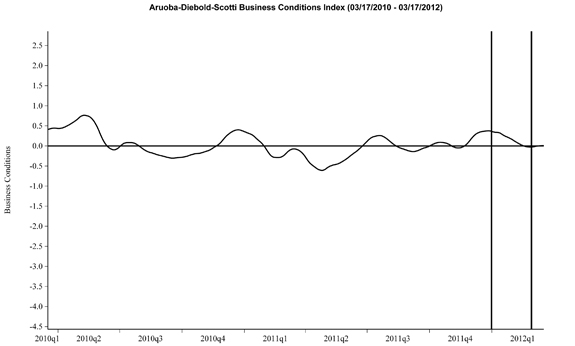

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 3-17-10 to 3-17-12:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the March 22 release, the LEI was at 95.5 and the CEI was at 104.0 in February.

An excerpt from the March 22 release:

Added Ken Goldstein, economist at The Conference Board: “Recent data reflect an economy that improved this winter. To be sure, an unseasonably mild winter has contributed to many of the recent positive economic reports. But the consistent signal for the leading series suggests that progress on jobs, output, and incomes may continue through the summer months, if not beyond.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1410.57 as this post is written