Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

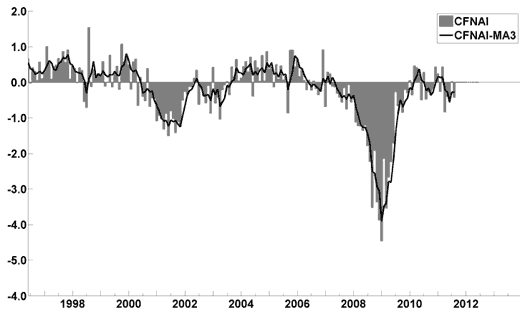

The September Chicago Fed National Activity Index (CFNAI)(pdf) updated as of September 26, 2011:

–

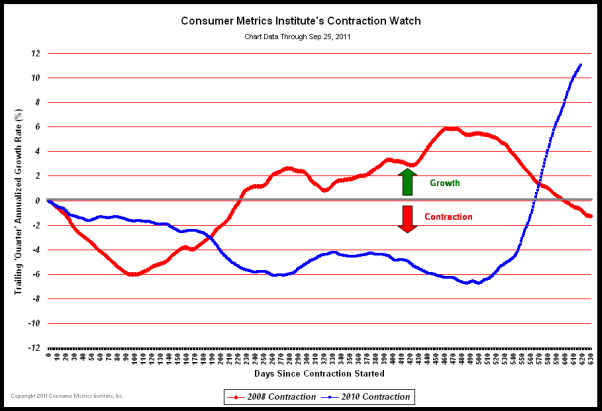

The Consumer Metrics Institute Contraction Watch:

–

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the September 6 update titled “Index forecasts weak growth through year end” :

The August update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, remaining below 2% through the second half of the year. Persistent unemployment, elevated debt levels, high energy and food prices and low confidence have stalled consumer spending. Businesses are hesitant to expand amid uncertainty.

–

The ECRI WLI (Weekly Leading Index):

As of 9/16/11 the WLI was at 122.2 and the WLI, Gr. was at -6.7%.

–

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of August 31 was at 41.5, as seen below:

An excerpt from the August 31 Press Release, titled “Threat of a Recession Looms According to Dow Jones Economic Sentiment Indicator” :

In August, federal spending issues and a ratings downgrade took its toll on economic sentiment, according to the Dow Jones Economic Sentiment Indicator. The indicator fell for the third straight month to 41.4 from 41.5 in July.

“The warning lights are flashing but the index is not quite calling recession, merely a very subdued state of sentiment about the economy,” says Dow Jones Newswires “Money Talks” columnist Alen Mattich.

–

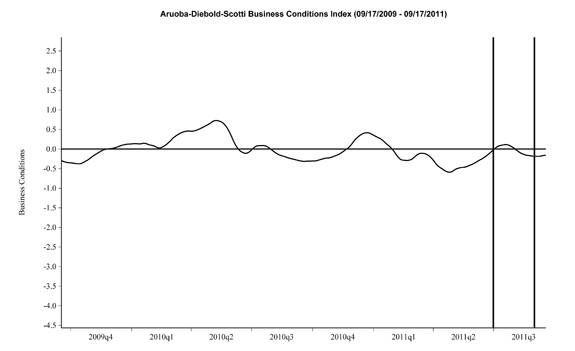

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 9-17-09 to 9-17-11:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the September 22 release, the LEI was at 116.2 and the CEI was at 103.3 in August.

An excerpt from the September 22 release:

Says Ataman Ozyildirim, economist at The Conference Board: “The August increase in the U.S. LEI was driven by components measuring financial and monetary conditions which offset substantially weaker components measuring expectations. The growth trend in the LEI has moderated and positive and negative contributors to the index have been roughly balanced. The leading indicators point to rising risks and volatility, and increasing concerns about the health of the expansion.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1162.95 as this post is written

What is it that you believe is taking place on a global economic perspective other than the world is in trouble. The keys and drivers of this crucifiction are? Where is America going between 2011-2014? Where are the economic drivers of the past that have generated full employment? The big economic drivers Computers, Cars, Homes, manufacturing etc. are now unable to sustain the populace and nothing has been put in place that will take up the next generation of economic drivers. Hence we seem to be going back to the days of FDR to look for a way out and that may be the answer until we are able to sustain a new generation of technology driven economic drivers.