Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

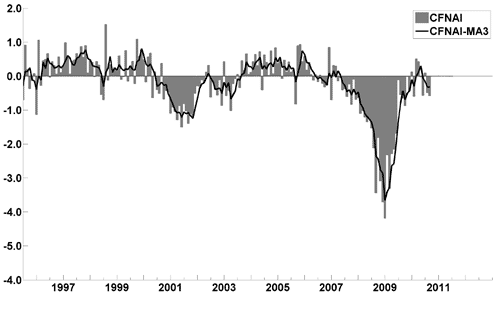

The October Chicago Fed National Activity Index (CFNAI)(pdf) updated as of October 25, 2010:

–

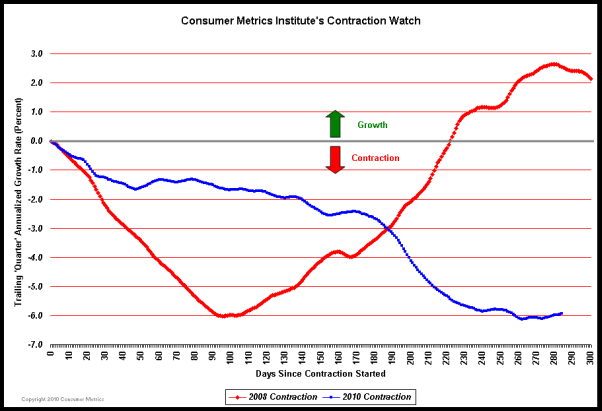

The Consumer Metrics Institute Contraction Watch:

–

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the October 28 Release, titled “Latest economic index forecasts weak growth through first quarter” :

“The October update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, slowing to 1.4% in October and then increasing to 2.0% in February and March, as weak housing and employment conditions continue to impede growth.”

The ECRI WLI (Weekly Leading Index):

As of 10/15/10 the WLI was at 122.1 and the WLI, Gr. was at -6.8%. A chart of the growth rates of the Weekly Leading and Weekly Coincident Indexes:

–

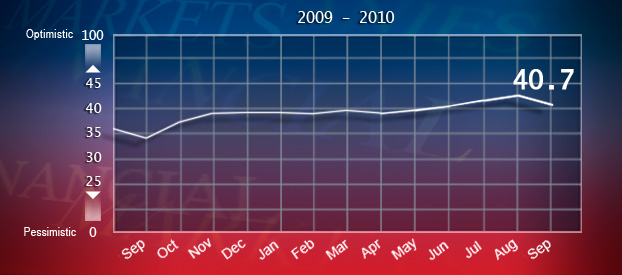

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of September 30 was at 40.7, as seen below:

An excerpt from the September 30 release:

“Following five months of modest but steady gains, the Dow Jones Economic Indicator (ESI) fell to 40.7 in September, down from 43.2 in August and its largest one-month drop since October 2008. And while the Indicator has historically declined in September, there are signs that the economic recovery is faltering with a sharp increase in negative economic stories during the last seven days of the month.”

–

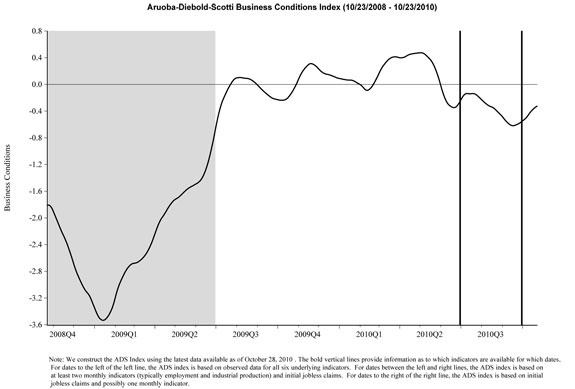

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, updated through 10-23-10:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the October 21 release, the LEI was at 110.4 and the CEI was at 101.4 in September.

An excerpt from the October 21, 2010 Press Release:

“Says Ken Goldstein, economist at The Conference Board: “More than a year after the recession officially ended, the economy is slow and has no forward momentum. The LEI suggests little change in economic conditions through the holidays or the early months of 2011.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

A Special Note concerning our economic situation is found here

SPX at 1183.78 as this post is written