The following commentary and chart is excerpted from the October 14, 2010 ContraryInvestor.com commentary. I find it interesting in a variety of different ways, and it raises a lot of questions with regard to the stock market, consumer confidence, QE1, and QE2…

_____

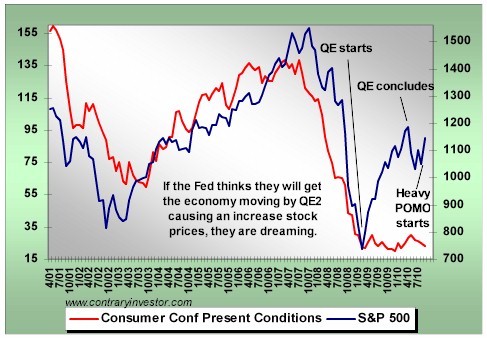

“We have not touched on consumer confidence for a good while, but now is the time. It’s time because of the certainty of QE ahead. Again, absolutely key question being, will QE2 positively influence the real economy? QE I was a strike out. And what of QE2? We believe a key indicator to watch as to whether QE2 will transmit to the real economy is the present conditions component of the headline consumer confidence index. Clearly the aim of QE2 is to inflate asset prices even further, let’s not beat around the bush about it. QE I inflated financial and commodity prices, but left real world prices of leveraged residential real estate and commercial real estate untouched. Moreover, QE I did not help headline consumer confidence recover. We’ll spare you the chart, but headline consumer confidence continues to rest at levels historically consistent with recession. Very quickly, the headline consumer confidence report is driven by two subcomponents that are present conditions and future expectations. Historically, the present conditions component of the headline number has been highly directionally correlated with the equity market over time. You can see exactly this in the chart below. Of course without the Fed overtly telling us this as a driver of their QE2 decision making, they are implicitly hoping higher stock prices (the assumed wealth effect) will engender accelerating consumer confidence, thereby motivating consumers to borrow and spend (or at worst just spend). This likewise had to be a key rationale of QE I as the Fed is surely aware of this prior cycle linkage between stock prices and confidence in present conditions.

But what stands out like a sore thumb in the chart above is that the present conditions component of the confidence report never recovered at all even as equities experienced one of the greatest 13 month rallies in history under QE I (exactly as we marked in the chart) from March of 2009 through April of this year. Moreover, and as is also clear, even as heavy Fed POMO was kicked off in August and September that lifted stocks to their greatest September gain in over seven decades, the present conditions component of the consumer confidence survey continued to deteriorate up through the most recent numbers. Message being? At least for now consumer confidence is not being bolstered by financial asset price inflation. A complete anomaly relative to historical experience. QE2 is clearly a bet this anomaly will fall back in rhythm with historical experience. So, we need to intently watch the present conditions component of the consumer confidence report ahead for clues as to whether QE2 will positively impact the real economy through bolstering consumer confidence, or otherwise.”

_____

A Special Note concerning our economic situation is found here

SPX at 1183.26 as this post is written