The following is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

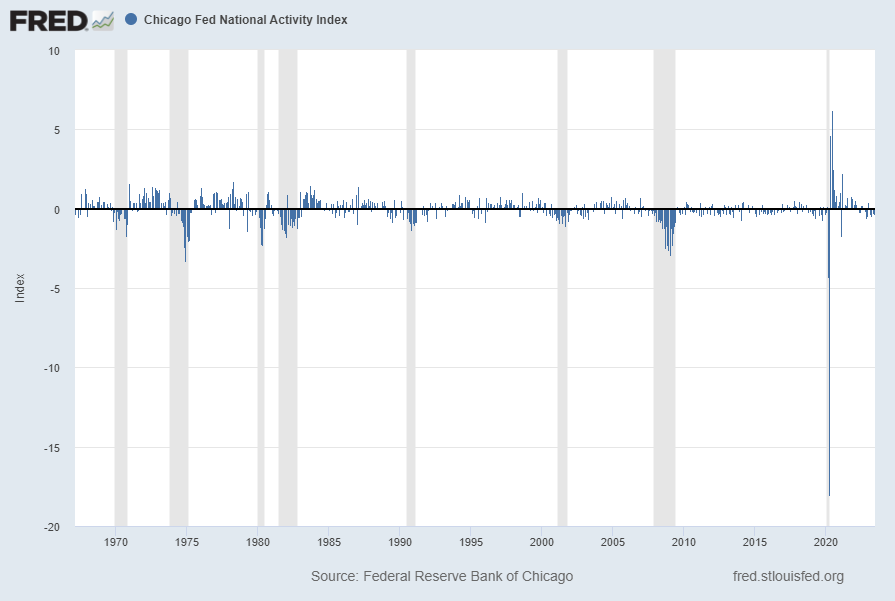

The July 2023 Chicago Fed National Activity Index (CFNAI) updated as of July 24, 2023:

The CFNAI, with a current reading of -.32:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed July 24, 2023:

https://fred.stlouisfed.org/series/CFNAI

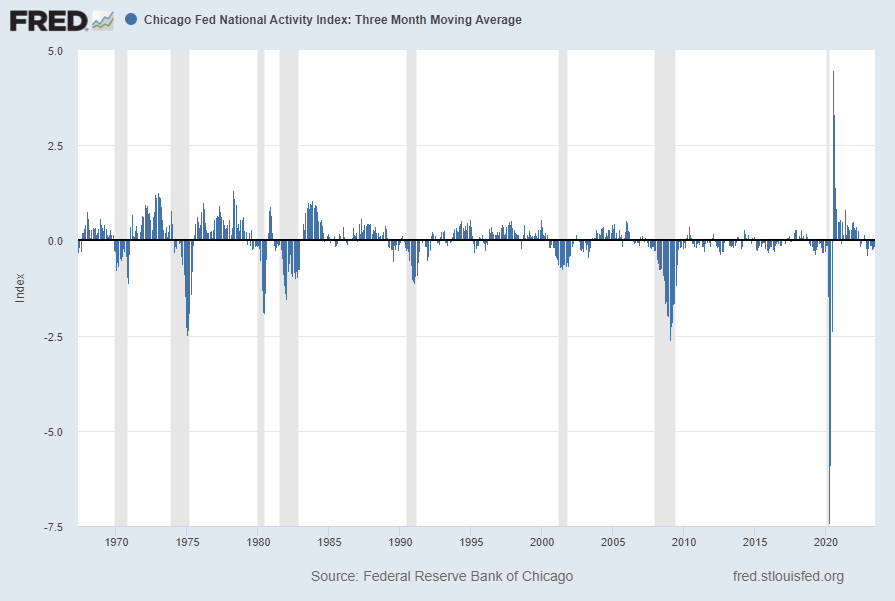

The CFNAI-MA3, with a current reading of -.16:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed July 24, 2023:

https://fred.stlouisfed.org/series/CFNAIMA3

–

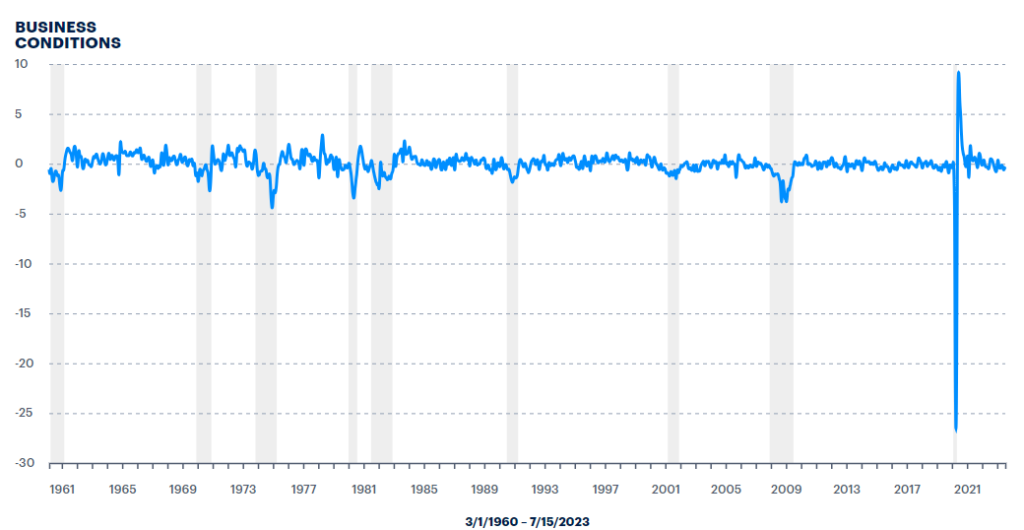

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index

The ADS Index as of July 20, 2023, reflecting data from March 1, 1960 through July 15, 2023, with last value -.285176:

–

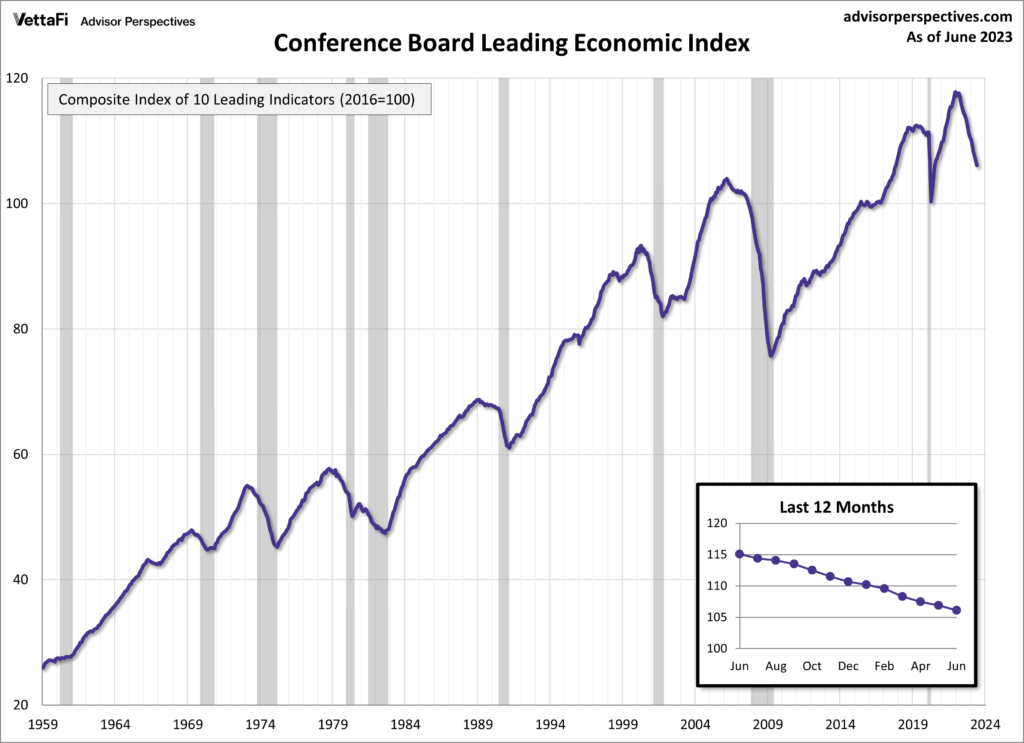

The Conference Board Leading Economic Index (LEI), Coincident Economic Index (CEI), and Lagging Economic Index (LAG):

As per the July 20, 2023 Conference Board press release the LEI was 106.1 in June, the CEI was 110.0 in June, and the LAG was 118.4 in June.

An excerpt from the release:

“The US LEI fell again in June, fueled by gloomier consumer expectations, weaker new orders, an increased number of initial claims for unemployment, and a reduction in housing construction,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “The Leading Index has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession. Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead. We forecast that the US economy is likely to be in recession from Q3 2023 to Q1 2024. Elevated prices, tighter monetary policy, harder-to-get credit, and reduced government spending are poised to dampen economic growth further.”

Here is a chart of the LEI from the Advisor Perspectives’ Conference Board Leading Economic Index (LEI) update of July 20, 2023:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4557.92 as this post is written