On September 28, 2022 The CFO Survey (formerly called the “Duke/CFO Global Business Outlook”) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

Financial decision-makers lowered their expectations for real growth in gross domestic product during the third quarter amid concerns over inflation and trouble finding skilled labor, according to the results of The CFO Survey, a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta.

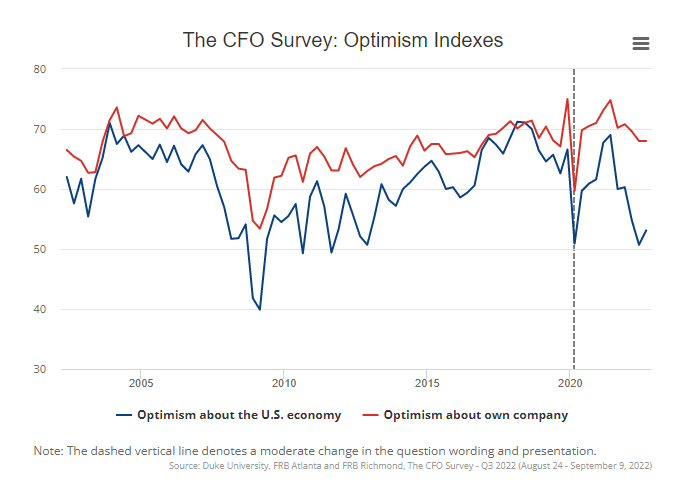

At the same time, CFOs said their optimism about the overall economy rose modestly from its recent low. Optimism about their own firms, though well below levels from a year ago, remained steady alongside some improvement in expectations for revenue, employment and cost growth.

CFOs said inflation was the most pressing concern facing their firms. Firms revised unit cost growth during 2022 down to 8.9 percent from 10.2 percent in the prior survey. These costs remain at elevated levels, and nearly all firms reported experiencing larger-than-normal cost increases.

As seen in the report’s detail:

CFOs on average expect real GDP to grow 0.9 percent over the next 12 months, down from an expectation of 1.5 percent last quarter. Across CFOs, the average probability of negative GDP growth over the next 12 months was 30 percent, compared to a 21 percent probability last quarter.

This CFO Survey contains an Optimism Index chart, with the blue line showing U.S. Optimism (with regard to the economy) at 53.1, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3698.43 as this post is written