Here is an update on various indicators that are supposed to predict and/or depict economic activity:

The April Chicago Fed National Activity Index (CFNAI)(pdf) updated as of April 28, 2011:

–

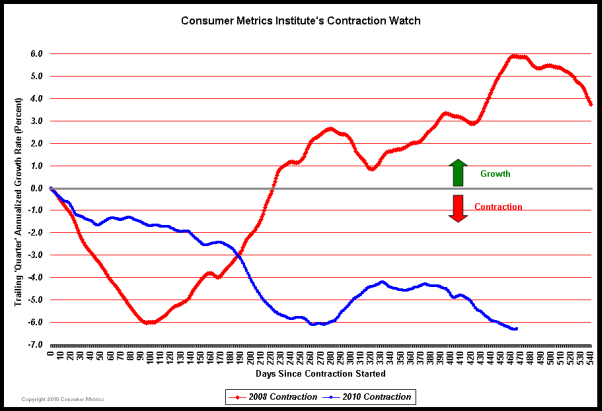

The Consumer Metrics Institute Contraction Watch:

–

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the March 23 Press Release, titled “Economic index forecasts stronger growth” :

“The March update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, increasing to 3.7% to 3.8% during the summer months. Gains in manufacturing, capital spending and exports are fueling the growth. Consumer spending and employment are expected to continue improving, though at a moderate pace.”

–

The ECRI WLI (Weekly Leading Index):

As of 4/15/11 the WLI was at 131.6 and the WLI, Gr. was at 7.7%. A chart of the growth rates of the Weekly Leading and Weekly Coincident Indexes:

–

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of March 31 was at 43.2, as seen below:

An excerpt from the March 31 Press Release:

“Weighted down by concerns about future consumer spending, the Dow Jones Economic Sentiment Indicator dropped 3.3 points to 43.2 in March. This is indicator’s lowest point since September 2010 and its sharpest drop since the autumn of 2008 when the global financial markets were collapsing.”

–

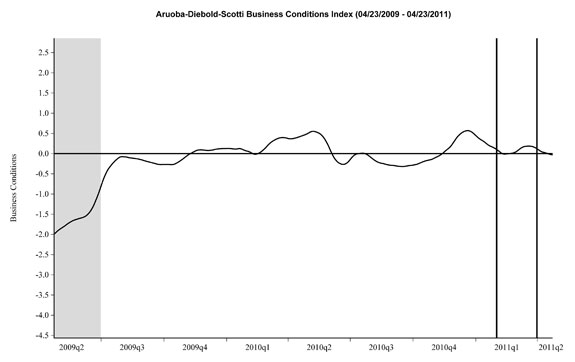

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 4-23-09 to 4-23-11:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the April 21 release, the LEI was at 114.1 and the CEI was at 102.9 in March.

An excerpt from the April 21, 2011 Press Release:

Says Ataman Ozyildirim, economist at The Conference Board: “The U.S. LEI continued to increase in March, pointing to strengthening business conditions in the near term. The March increase was led by the interest rate spread and housing permits components, while consumer expectations dropped. The U.S. CEI, a monthly measure of current economic conditions, also continued to rise, led by gains in industrial production and employment.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1360.36 as this post is written