Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

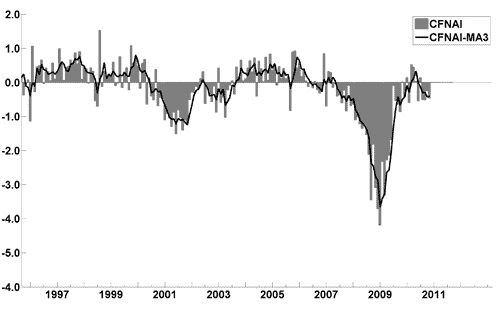

The December Chicago Fed National Activity Index (CFNAI)(pdf) updated as of December 20, 2010:

–

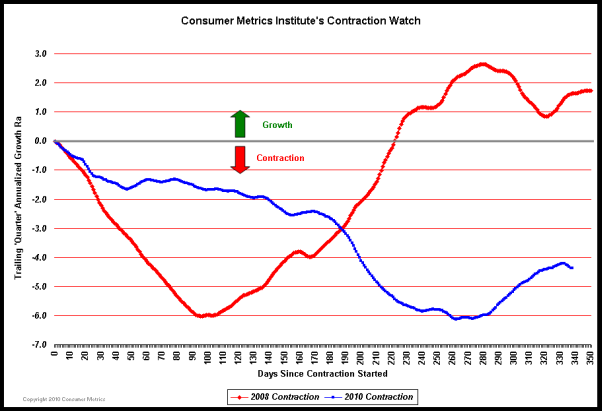

The Consumer Metrics Institute Contraction Watch:

–

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the November 24 Release :

“The November update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, stabilizing at 2.2% in December through March and 2.1% in April. Weak housing and employment combined with high debt and tight credit continue to impede growth.”

–

The ECRI WLI (Weekly Leading Index):

As of 12/10/10 the WLI was at 127.4 and the WLI, Gr. was at -.1%. A chart of the growth rates of the Weekly Leading and Weekly Coincident Indexes:

–

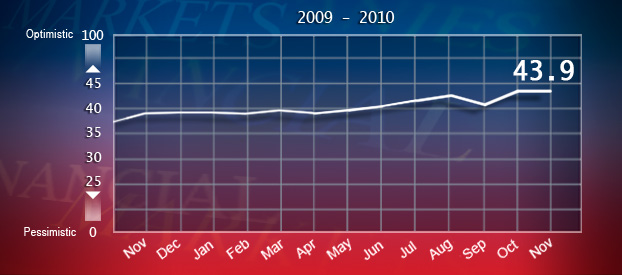

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of November 30 was at 43.9, as seen below:

An excerpt from the November 30 News Release:

““The ESI signals that the economy is in a holding pattern,” Dow Jones Newswires “Money Talks” Columnist Alen Mattich said. “If it had risen sharply, confirming October’s strong rise, then it would have been a very positive sign. Instead we are seeing an economy still poised between modest growth and a slipping back.”

–

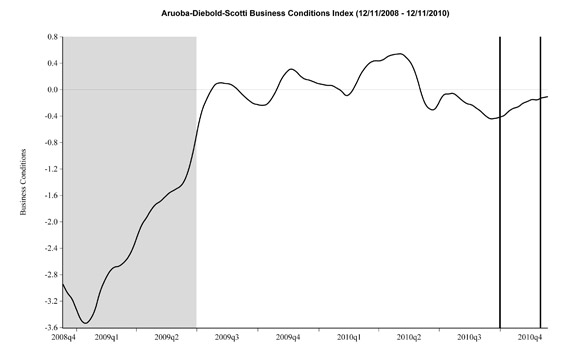

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 12-11-08 to 12-11-10:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the December 17 release, the LEI was at 112.4 and the CEI was at 101.7 in November.

An excerpt from the December 17, 2010 Press Release:

“Says Ataman Ozyildirim, economist at The Conference Board: “November’s sharp increase in the LEI, the fifth consecutive gain, is an early sign that the expansion is gaining momentum and spreading. Nearly all components rose in November. Continuing strength in financial indicators is now joined by gains in manufacturing and consumer expectations, but housing remains weak.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

A Special Note concerning our economic situation is found here

SPX at 1254.60 as this post is written