Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

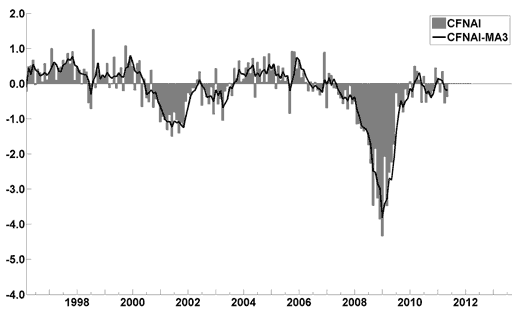

The June Chicago Fed National Activity Index (CFNAI)(pdf) updated as of June 23, 2011:

–

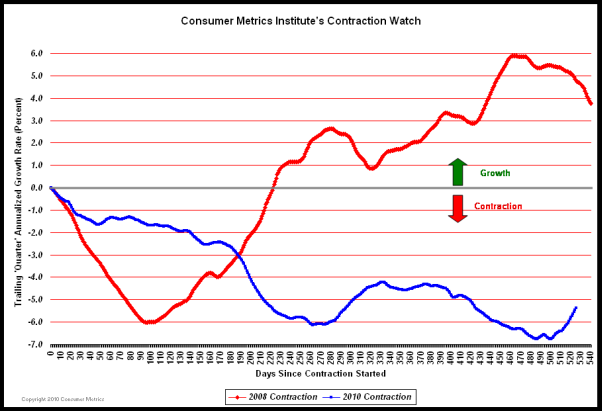

The Consumer Metrics Institute Contraction Watch:

–

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the June 22 Press Release, titled “Index forecasts stronger growth this fall” :

The June update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, remaining below 3% through the summer and then gaining strength in October and November with 3.3%-3.4% growth rates. Temporary automotive supply disruptions resulting from the Japan earthquake plus high energy and food prices are the main reasons for the slowdown. A return to stronger growth is expected in the fall as automotive supply levels return to normal, businesses increase equipment spending, export growth remains strong and employment slowly improves. The weak housing market and concerns about European debt remain drags on the recovery.

–

The ECRI WLI (Weekly Leading Index):

As of 6/17/11 the WLI was at 127.0 and the WLI, Gr. was at 2.9%. A chart of the growth rates of the Weekly Leading and Weekly Coincident Indexes:

–

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of May 31 was at 46.7, as seen below:

An excerpt from the May 31 Press release:

The depiction of the economy in U.S. newspapers continued to be more negative than positive in May, lengthening a long-term trend held since November 2007. In May, the Dow Jones Economic Sentiment Indicator hit 46.6, unchanged since April and more than 3 points away from the positive side of the 100-point scale.

–

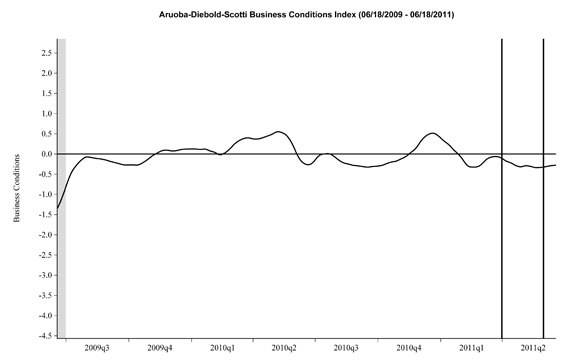

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 6-18-09 to 6-18-11:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the June 17 release, the LEI was at 114.7 and the CEI was at 102.9 in May.

An excerpt from the June 17 Press Release:

Says Ataman Ozyildirim, economist at The Conference Board: “The U.S. LEI rebounded in May and resumed its upward trend with a majority of the components supporting this gain. The Coincident Economic Index, a monthly measure of current economic conditions, continued to increase slowly but steadily. Overall, despite short-term volatility, the composite indexes still point to expanding economic activity in the coming months.”

Says Ken Goldstein, economist at The Conference Board: “Modest economic growth is being buffeted by some strong headwinds, including high gas and food prices and a soft housing market. The economy will likely continue to grow through the summer and fall, however it will be choppy.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1268.45 as this post is written