The following is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

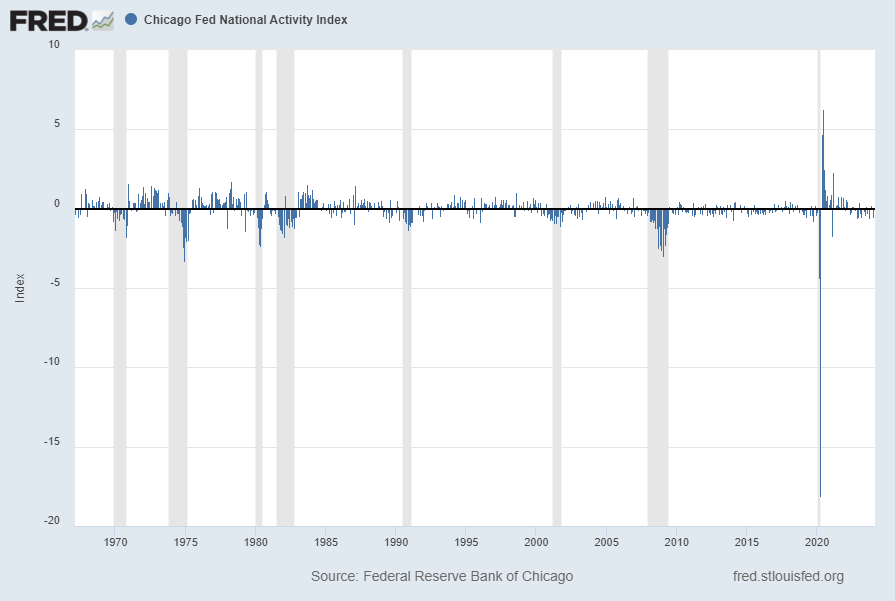

The March 2024 Chicago Fed National Activity Index (CFNAI) updated as of March 25, 2024:

The CFNAI, with a current reading of .05:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed March 25, 2024:

https://fred.stlouisfed.org/series/CFNAI

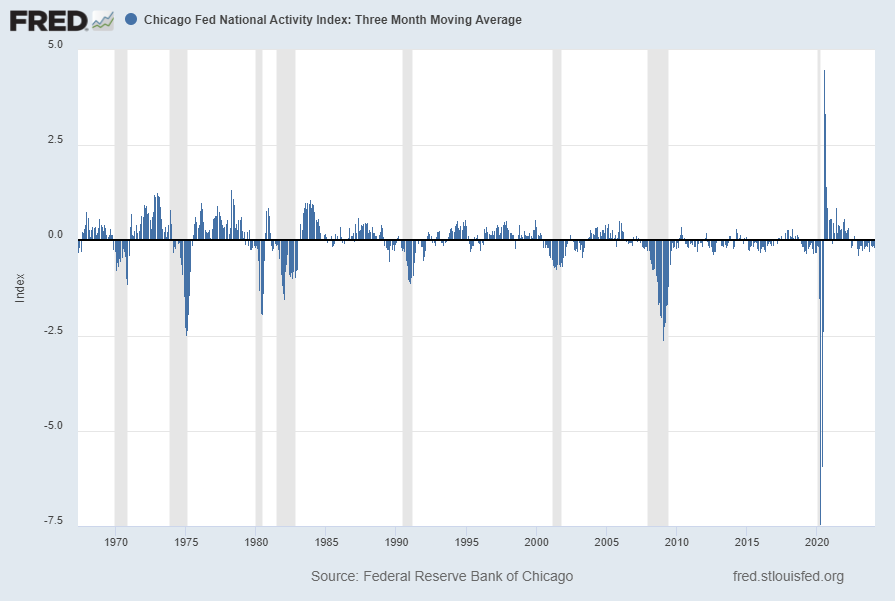

The CFNAI-MA3, with a current reading of -.18:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed March 25, 2024:

https://fred.stlouisfed.org/series/CFNAIMA3

–

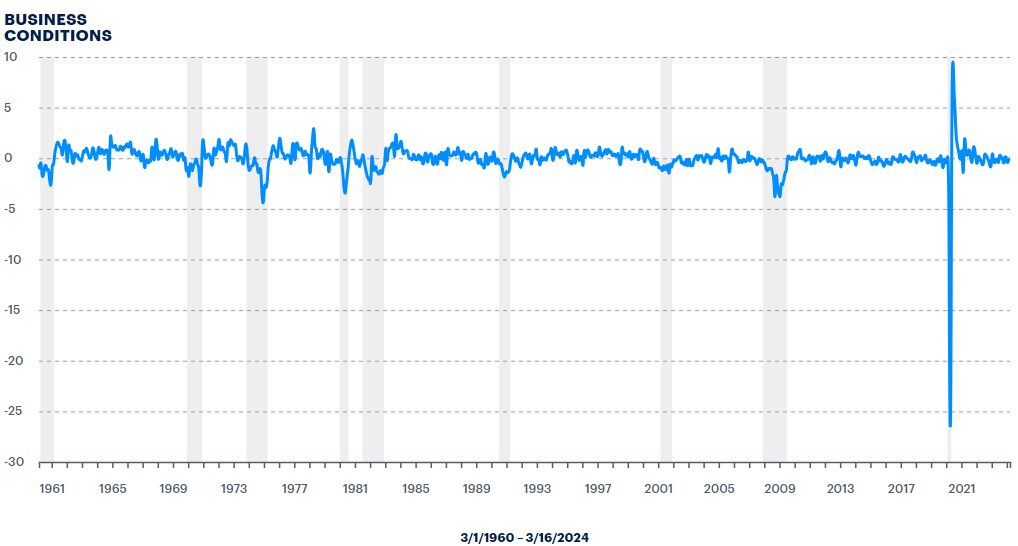

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index

The ADS Index as of March 21, 2024, reflecting data from March 1, 1960 through March 16, 2024, with last value -.0405321:

–

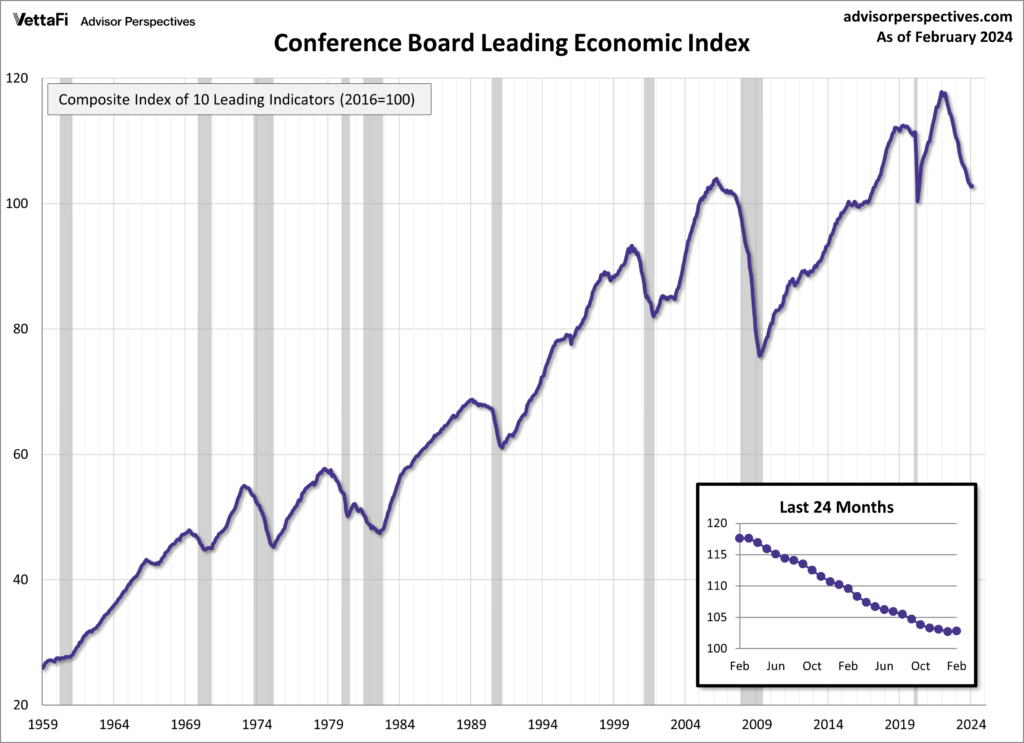

The Conference Board Leading Economic Index (LEI), Coincident Economic Index (CEI), and Lagging Economic Index (LAG):

As per the March 21, 2024 Conference Board press release the LEI was 102.8 in February, the CEI was 112.3 in February, and the LAG was 118.8 in February.

An excerpt from the release:

“The U.S. LEI rose in February 2024 for the first time since February 2022,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Strength in weekly hours worked in manufacturing, stock prices, the Leading Credit Index™, and residential construction drove the LEI’s first monthly increase in two years. However, consumers’ expectations and the ISM® Index of New Orders have yet to recover, and the six- and twelve-month growth rates of the LEI remain negative. Despite February’s increase, the Index still suggests some headwinds to growth going forward. The Conference Board expects annualized US GDP growth to slow over the Q2 to Q3 2024 period, as rising consumer debt and elevated interest rates weigh on consumer spending.”

Here is a chart of the LEI from the Advisor Perspectives’ Conference Board Leading Economic Index (LEI) update of March 21, 2024:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 5226.50 as this post is written