The following is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

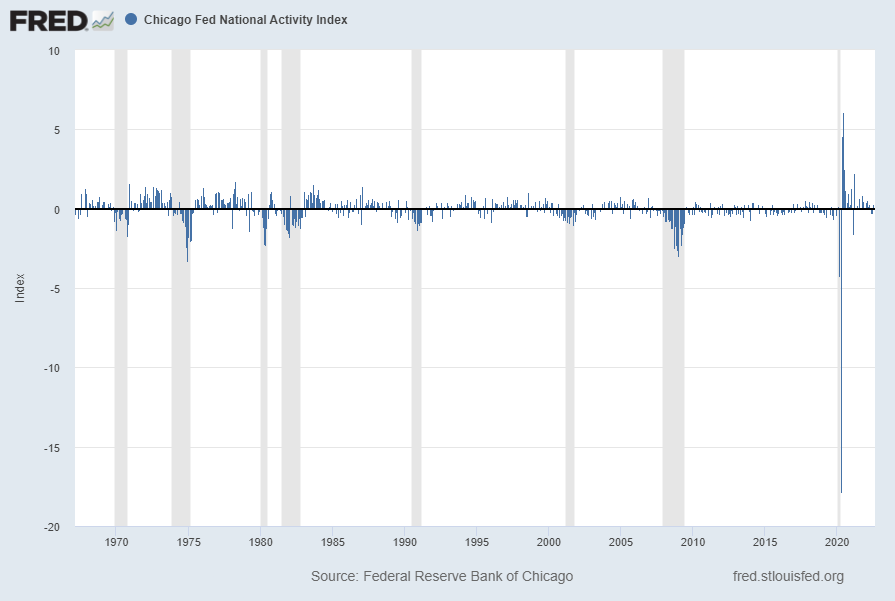

The September 2022 Chicago Fed National Activity Index (CFNAI) updated as of September 26, 2022:

The CFNAI, with a current reading of 0.0:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed September 26, 2022:

https://fred.stlouisfed.org/series/CFNAI

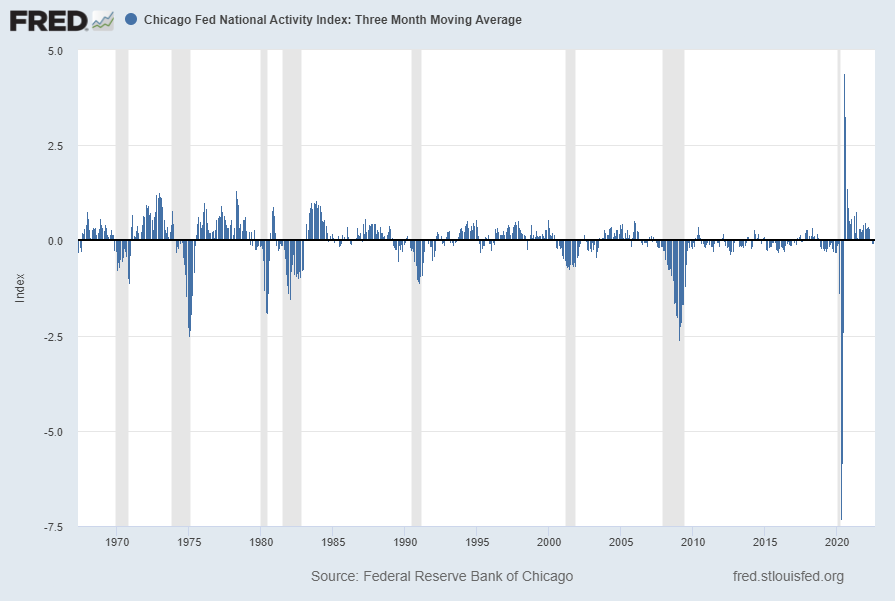

The CFNAI-MA3, with a current reading of .01:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed September 26, 2022:

https://fred.stlouisfed.org/series/CFNAIMA3

–

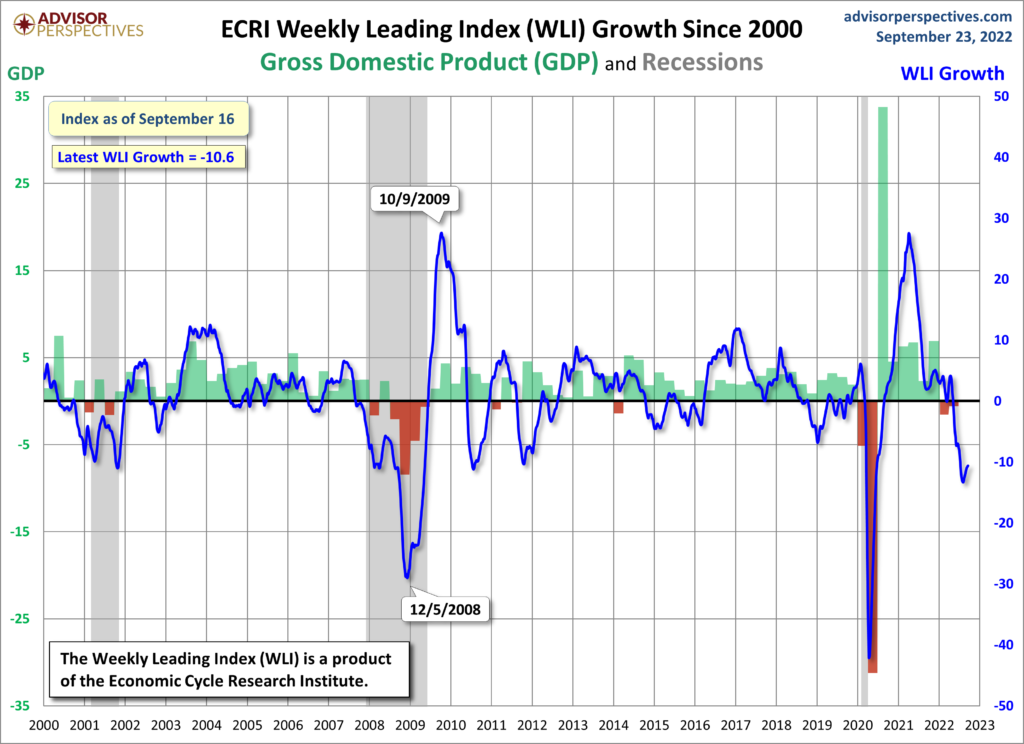

The ECRI WLI (Weekly Leading Index):

As of September 23, 2022 (incorporating data through September 16, 2022) the WLI was at 145.3 and the WLI, Gr. was at -10.6%.

A chart of the WLI,Gr., from the Advisor Perspectives’ ECRI update post of September 23, 2022:

–

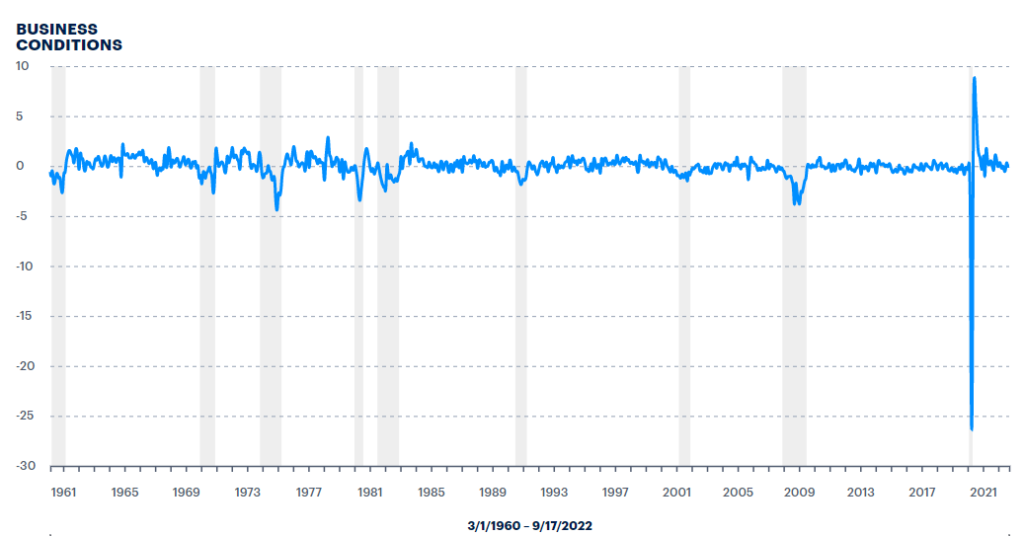

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index

The ADS Index as of September 22, 2022, reflecting data from March 1, 1960 through September 17, 2022, with last value .0145106:

–

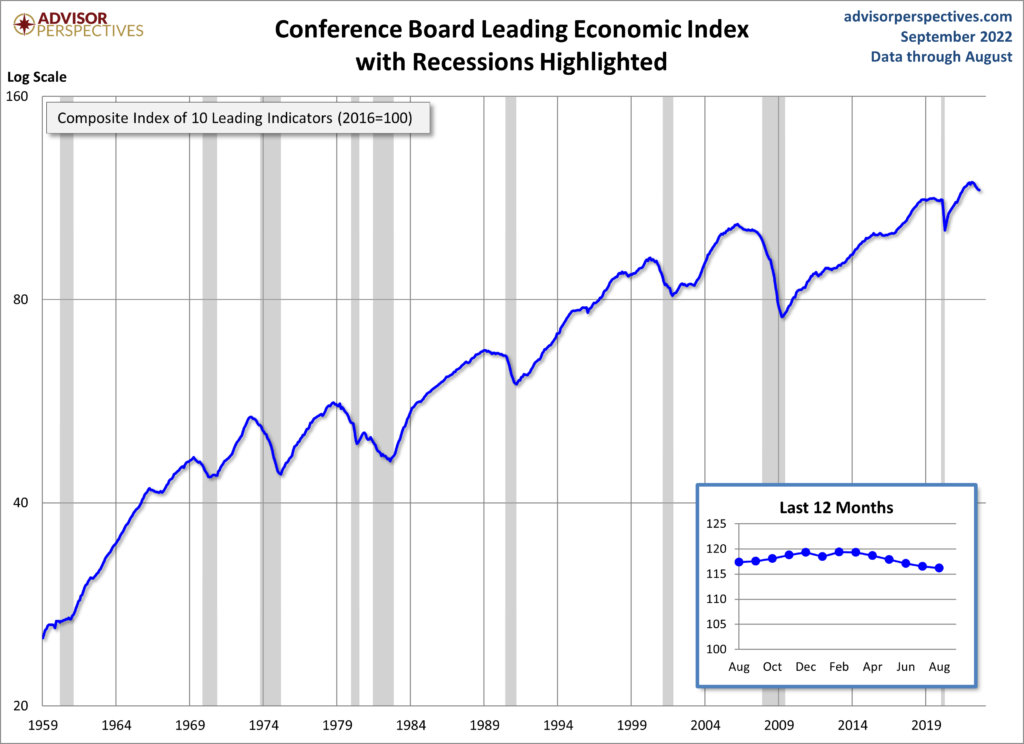

The Conference Board Leading Economic Index (LEI), Coincident Economic Index (CEI), and Lagging Economic Index (LAG):

As per the September 22, 2022 Conference Board press release the LEI was 116.2 in August, the CEI was 108.7 in August, and the LAG was 115.4 in August.

An excerpt from the release:

“The US LEI declined for a sixth consecutive month potentially signaling a recession,” Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “Among the index’s components, only initial unemployment claims and the yield spread contributed positively over the last six months—and the contribution of the yield spread has narrowed recently.”

“Furthermore, labor market strength is expected to continue moderating in the months ahead. Indeed, the average workweek in manufacturing contracted in four of the last six months—a notable sign, as firms reduce hours before reducing their workforce. Economic activity will continue slowing more broadly throughout the US economy and is likely to contract. A major driver of this slowdown has been the Federal Reserve’s rapid tightening of monetary policy to counter inflationary pressures. The Conference Board projects a recession in the coming quarters.”

Here is a chart of the LEI from the Advisor Perspectives’ Conference Board Leading Economic Index (LEI) update of September 22, 2022:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3711.38 as this post is written