U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. This post is the latest in a series of posts indicating facets of U.S. economic weakness or a notably low growth rate.

The level and trend of economic growth is especially notable at this time. As seen in various measures and near-term projections, the U.S. economy had undergone an outsized level of economic contraction in 2020. However, most people believe (and virtually all prominent economic forecasts indicate) that this historic level of contraction will have proven ephemeral in nature; i.e. an economic expansion will continue.

As seen in the April 2022 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for 2.57% GDP growth in 2022, 2.18% GDP growth in 2023, and 2.06% GDP growth in 2024.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

__

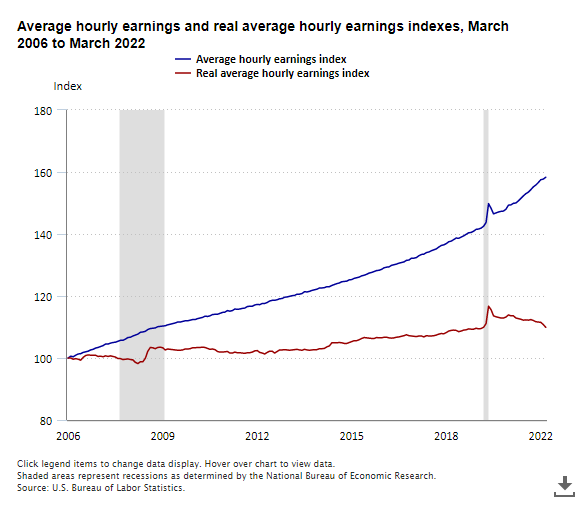

Real Average Hourly Earnings

Various measures of (nominal) average hourly earnings continue to show significant growth. However, due to continuing high inflation, Real Average Hourly Earnings continues to shrink. Shown below is a chart of earnings measures as seen in The Economics Daily of April 19, 2022 titled “Real average hourly earnings down .8 percent from February to March 2022”:

As seen in this The Economics Daily:

Average hourly earnings increased 5.6 percent for the 12 months ended in March 2022 and 58.3 percent from March 2006 to March 2022. After adjusting for inflation, real average hourly earnings decreased 2.7 percent for the 12 months ended in March 2022 and increased 9.9 percent from March 2006 to March 2022.

source: Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Real average hourly earnings down 0.8 percent from February to March 2022 at https://www.bls.gov/opub/ted/2022/real-average-hourly-earnings-down-0-8-percent-from-february-to-march-2022.htm (visited May 09, 2022)

__

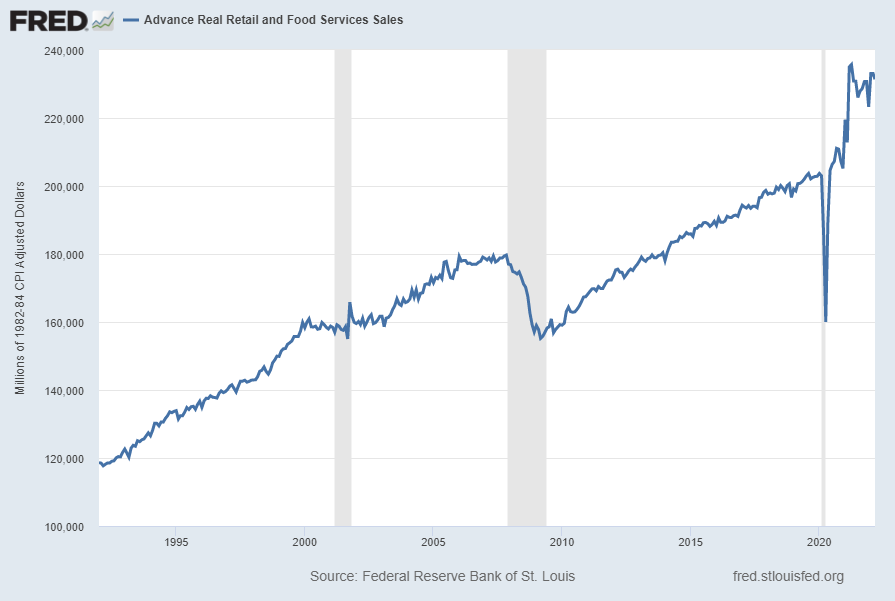

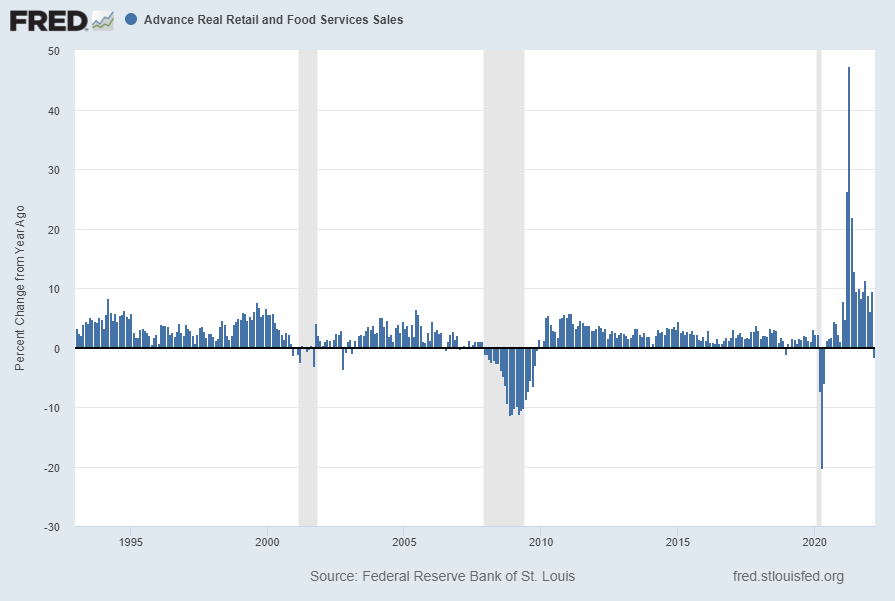

Advance Real Retail and Food Services Sales (RRSFS)

While the Advance Retail Sales: Retail Trade and Food Services (RSAFS) measure continues to advance, the trend when viewed from a “Real” (i.e. inflation-adjusted) basis appears (far) less robust.

Shown below is retail sales on a real basis [the Advance Real Retail and Food Services Sales (RRSFS) measure] with last value of $231,389 Million through March, last updated April 14, 2022:

Displayed below is this same RRSFS measure on a “Percent Change From Year Ago” basis, which has now turned negative with a last value of -1.5%:

source: Federal Reserve Bank of St. Louis, Advance Real Retail and Food Services Sales [RRSFS], retrieved from FRED, Federal Reserve Bank of St. Louis; May 9, 2022: https://fred.stlouisfed.org/series/RRSFS

__

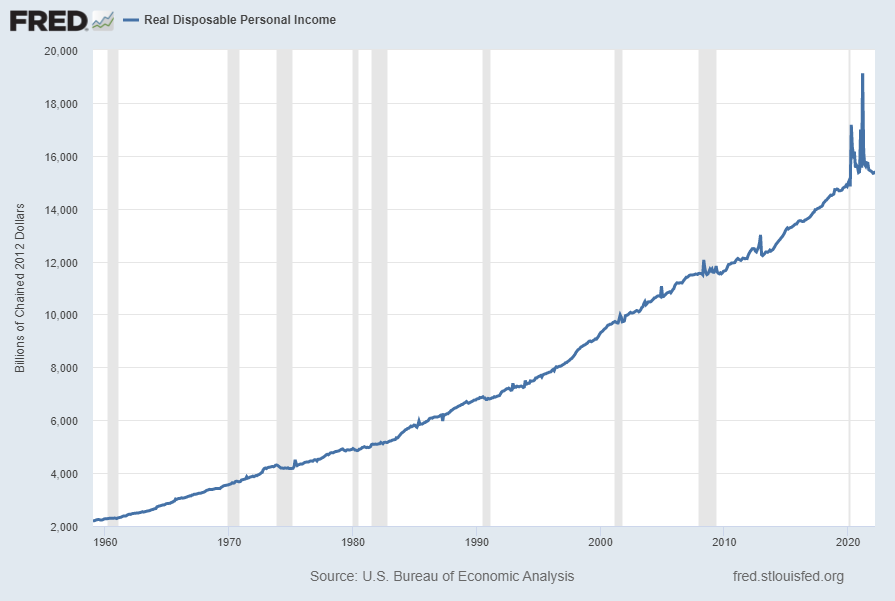

Real Disposable Personal Income (DSPIC96)

“Real Disposable Personal Income” (DSPIC96) has been volatile since 2020, and ongoing high inflation is presenting a hurdle to its continued growth. Shown below is this measure with last value of $15,308.50 through March, last updated April 29, 2022:

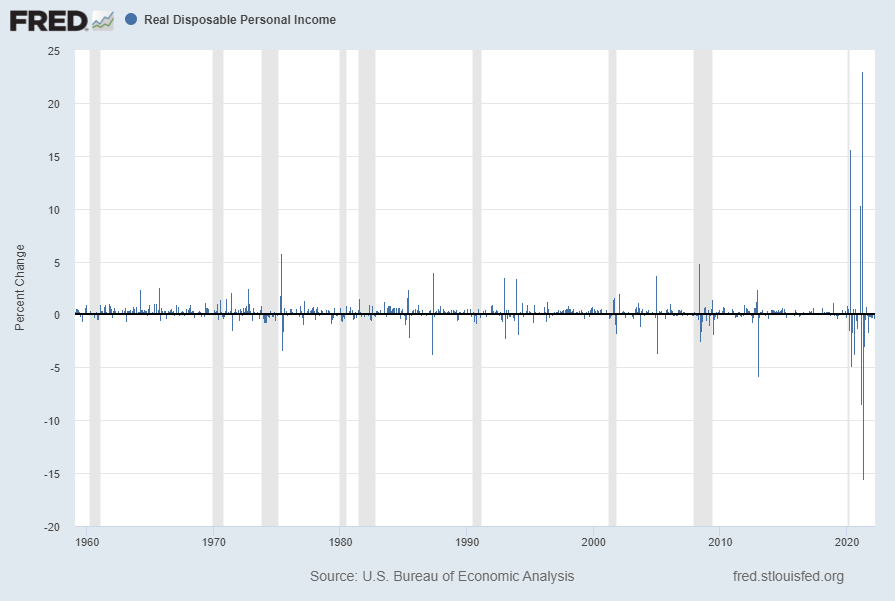

Below is this measure displayed on a “Percent Change” (from prior month) basis with last value of -.4%:

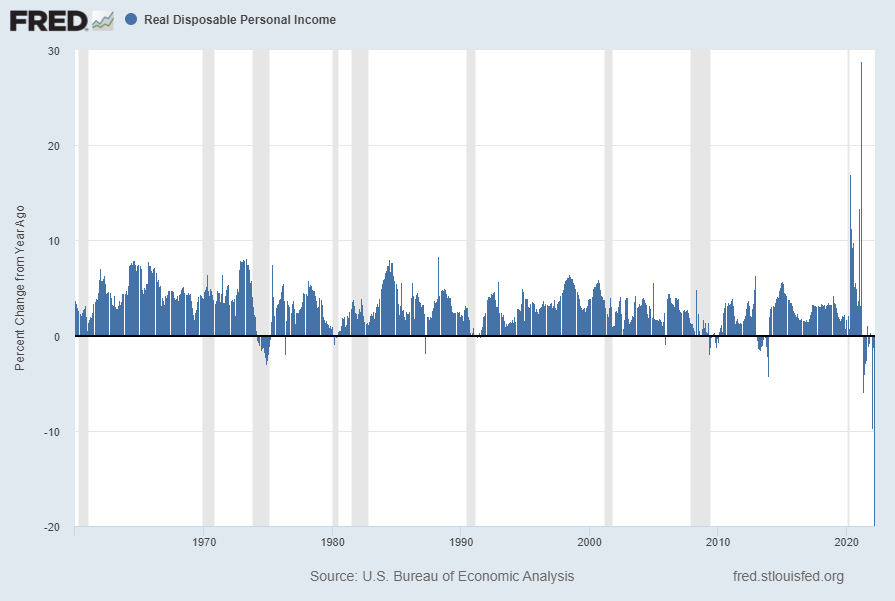

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -19.9%:

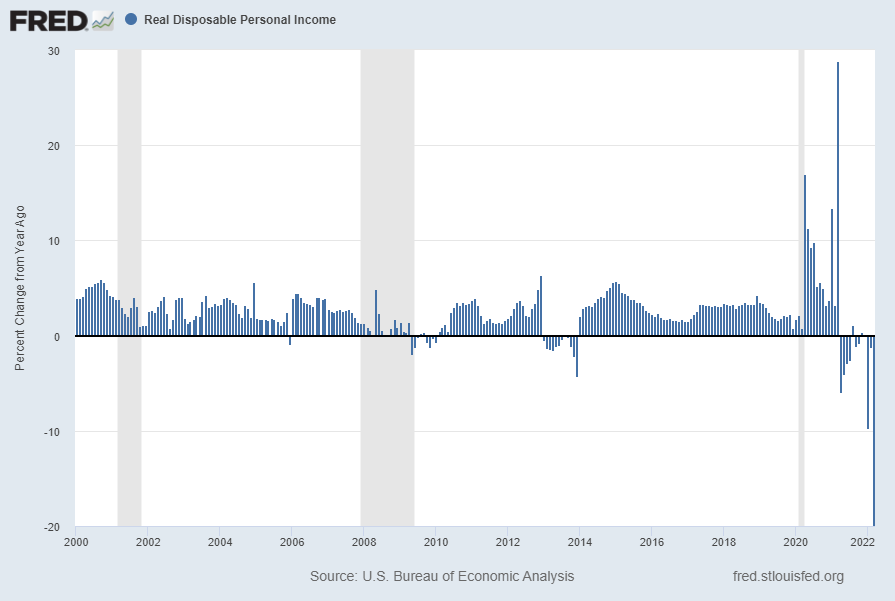

Below is this same measure (“Percent Change From Year Ago” basis) but from the year 2000 onward:

source: U.S. Bureau of Economic Analysis, Real Disposable Personal Income [DSPIC96], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed May 9, 2022: https://fred.stlouisfed.org/series/DSPIC96

__

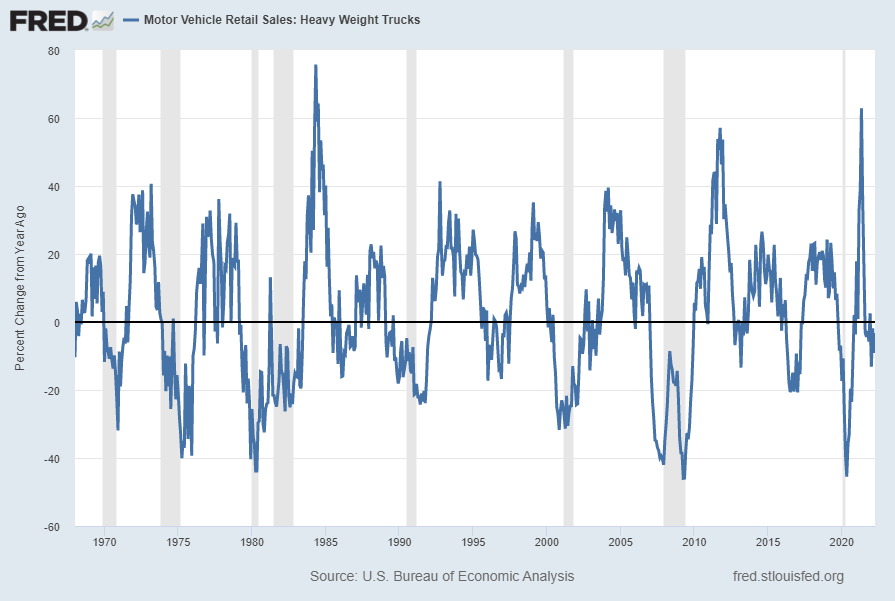

Motor Vehicle Retail Sales: Heavy Weight Trucks (HTRUCKSSA)

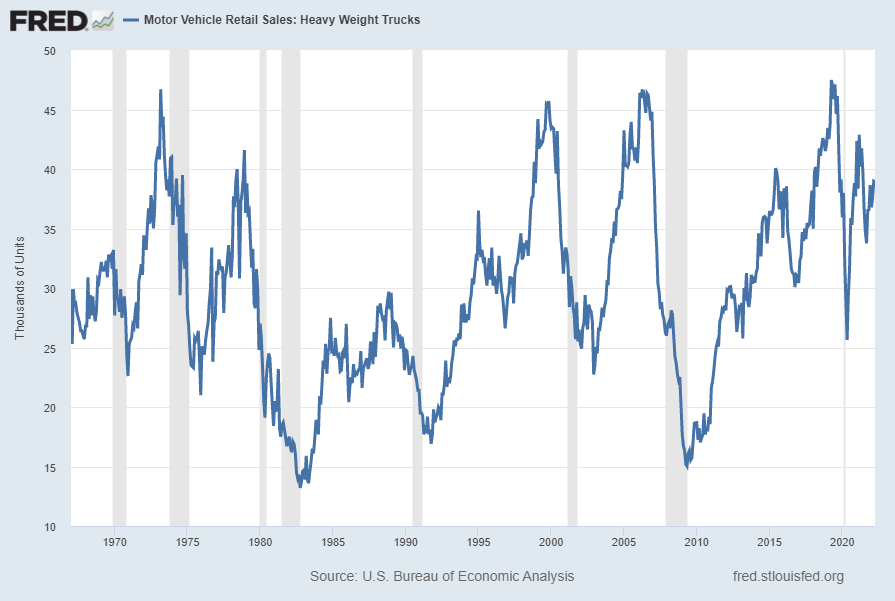

Sales of “Heavy Weight Trucks” (HTRUCKSSA) has recently been volatile. Shown below is this measure with last value of 38.889 Thousand through April 2022, last updated May 6, 2022:

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -3.1%:

source: U.S. Bureau of Economic Analysis, Motor Vehicle Retail Sales: Heavy Weight Trucks [HTRUCKSSA], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed May 9, 2022: https://fred.stlouisfed.org/series/HTRUCKSSA

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate slow economic growth or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3991.24 as this post is written