On June 10, 2021, the Zillow Q2 2021 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the press release:

With housing demand showing no signs of slowing from a pandemic-fueled boom in the second half of 2020, the expert panel has once again adjusted their home price growth expectations upward. The panel’s average home value growth prediction for 2021 is 8.7% — the highest for any year since the inception of the quarterly survey in 2010. That’s up from 6.2% last quarter and more than double the expectation from the Q4 2020 survey (4.2%). Home value growth is expected to moderate down to 5.1% in 2022, according to the panel, which would still be strong growth compared to a historical average of about 4%.

“A profound shift in housing preferences, adoption of remote employment, low mortgage rates, and the recovering economy continue to stoke demand in the single-family market and drive prices higher,” said Terry Loebs, founder of Pulsenomics. “Strict zoning regulations, an acute labor shortage, and record-high materials costs are constraining new construction, compounding disequilibrium, and reinforcing expectations that above-normal rates of home price growth will persist beyond the near-term.”

–

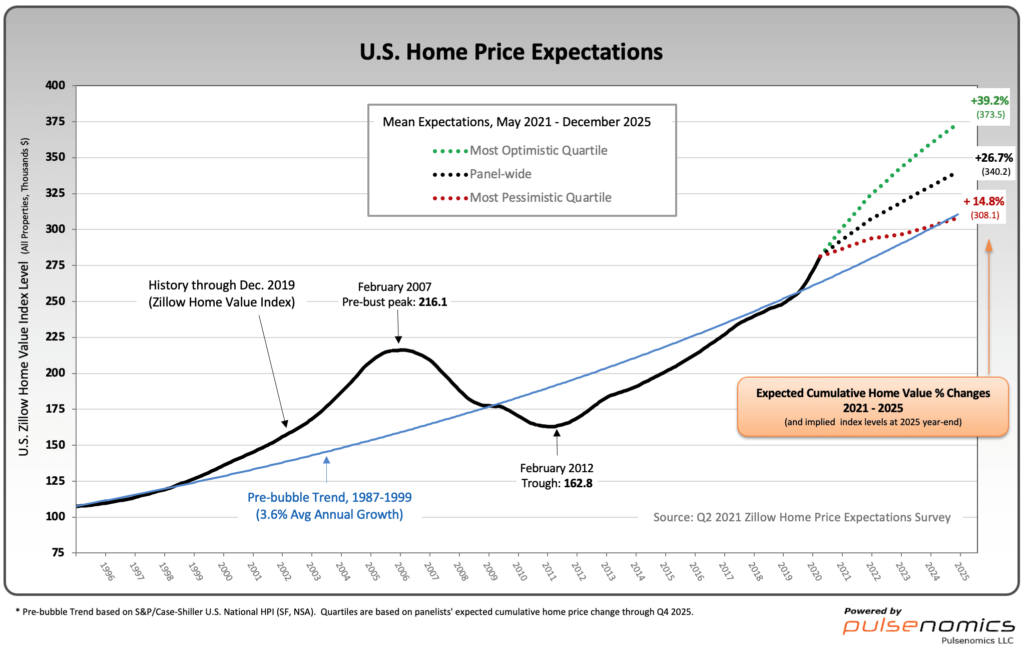

Various Q2 2021 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q2 2021 Home Price Expectations Survey is interesting. Of the 109 survey respondents, only 3 (of the displayed responses) forecasts a cumulative price decrease through 2024.

The Median Cumulative Home Price Appreciation for years 2020-2024 is seen as 8.7%, 14.35%, 17.97%, 22.69%, and 27.05%, respectively.

For a variety of reasons, I continue to believe that these forecasts will prove far too optimistic in hindsight.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4236.43 as this post is written