I find the following charts to be disturbing. These charts would be disturbing at any point in the economic cycle; that they (on average) depict such a tenuous situation now – 109 months after the official (as per the September 20, 2010 NBER BCDC announcement) June 2009 end of the recession – is especially notable.

These charts raise a lot of questions. As well, they highlight the “atypical” nature of our economic situation from a long-term historical perspective.

All of these charts are from the Federal Reserve, and represent the most recently updated data.

(click on charts to enlarge images)

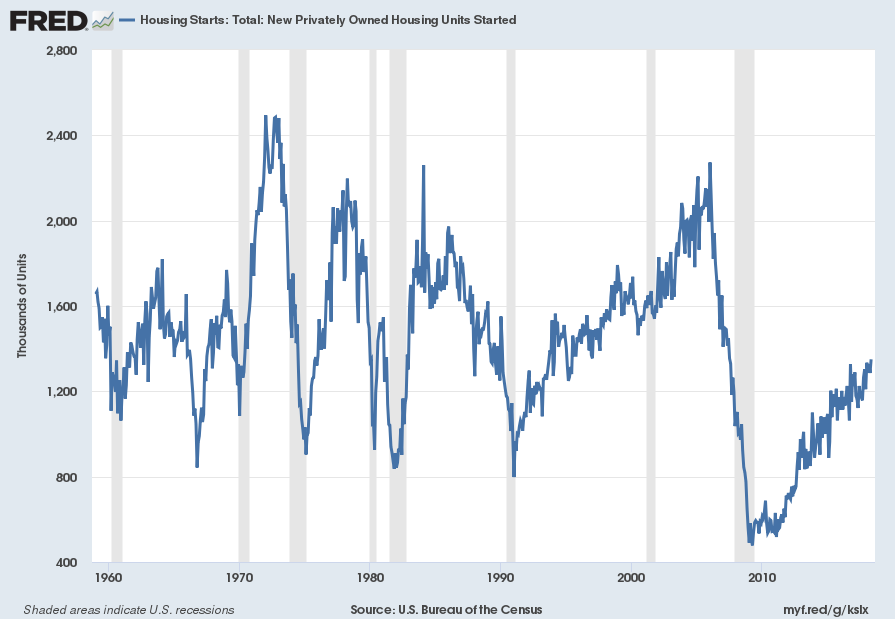

Housing starts (last updated June 19, 2018):

US. Bureau of the Census, Housing Starts: Total: New Privately Owned Housing Units Started [HOUST], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/HOUST/, July 13, 2018.

–

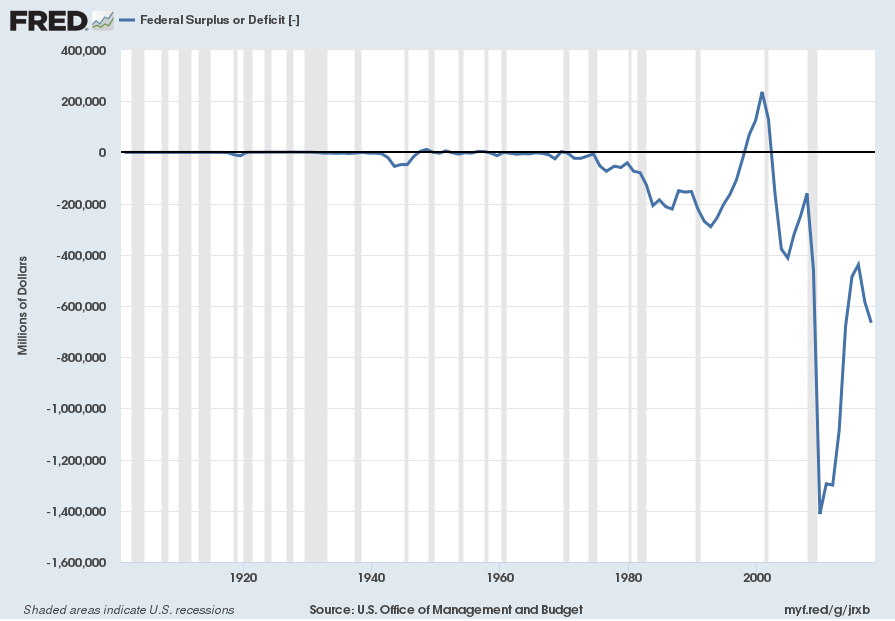

The Federal Deficit (last updated March 27, 2018):

US. Office of Management and Budget, Federal Surplus or Deficit [-] [FYFSD], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/FYFSD/, July 13, 2018.

–

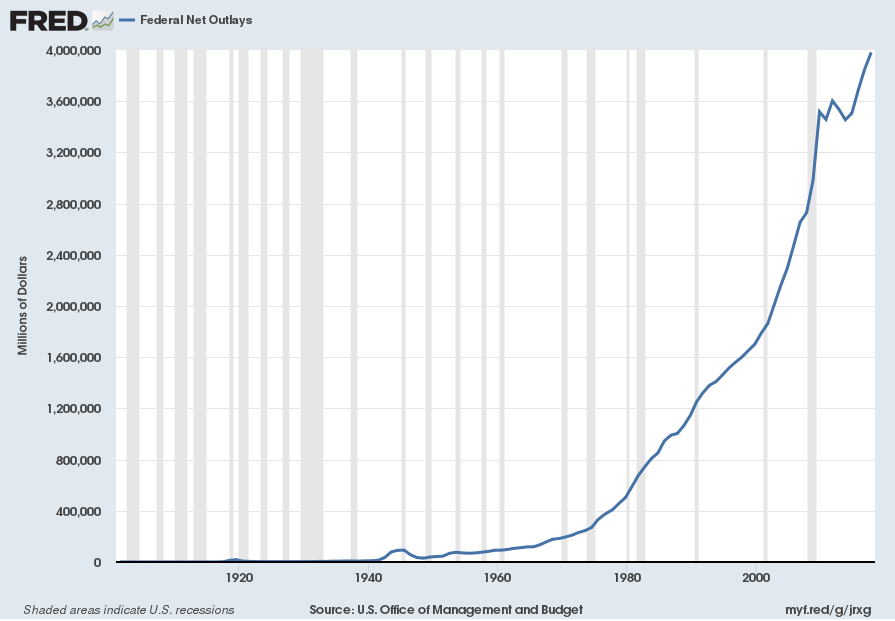

Federal Net Outlays (last updated March 27, 2018):

US. Office of Management and Budget, Federal Net Outlays [FYONET], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/FYONET/, July 13, 2018.

–

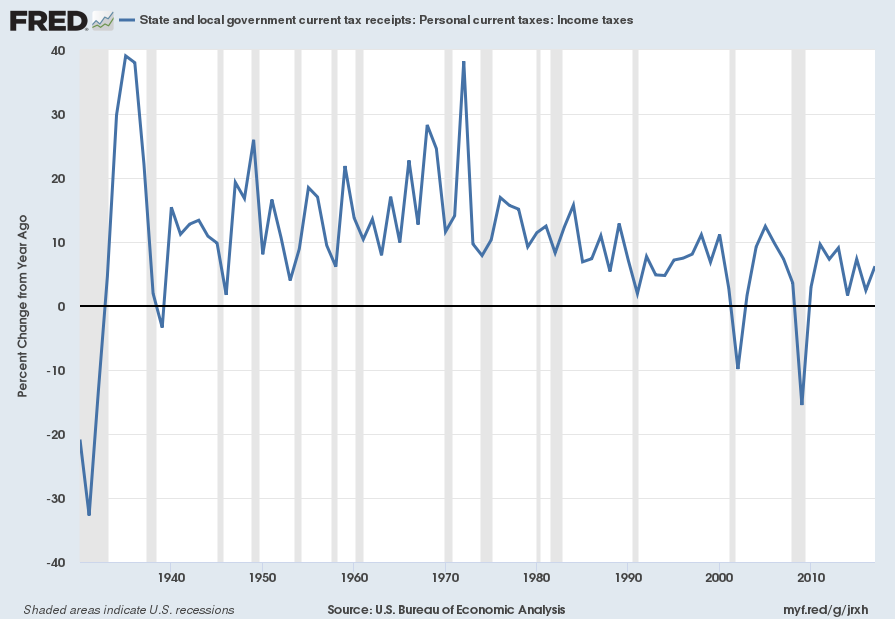

State & Local Personal Income Tax Receipts (% Change from Year Ago)(last updated March 28, 2018):

US. Bureau of Economic Analysis, State and local government current tax receipts: Personal current taxes: Income taxes [ASLPITAX], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/ASLPITAX/, July 13, 2018.

–

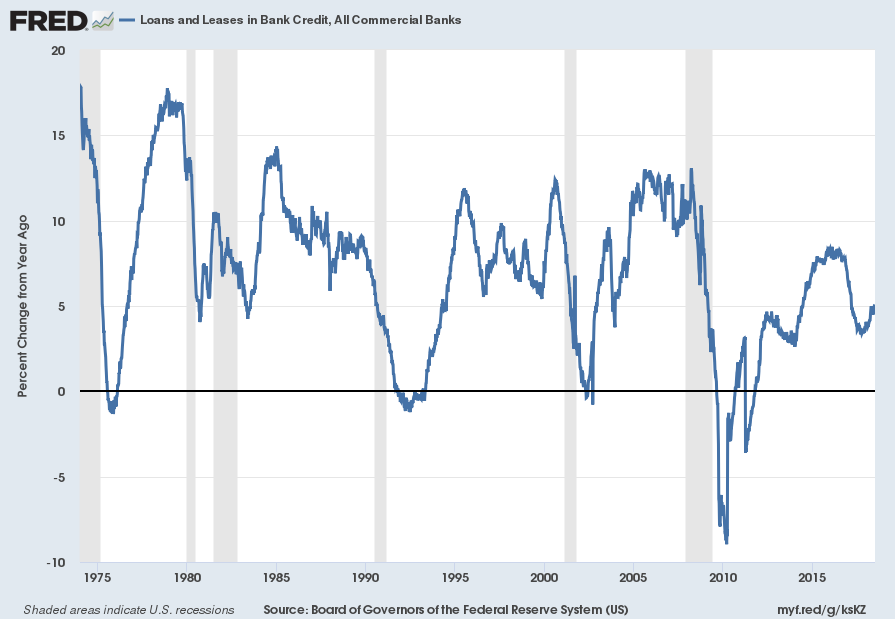

Total Loans and Leases of Commercial Banks (% Change from Year Ago)(last updated July 6, 2018):

Board of Governors of the Federal Reserve System (US), Loans and Leases in Bank Credit, All Commercial Banks [TOTLL], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/TOTLL/, July 13, 2018.

–

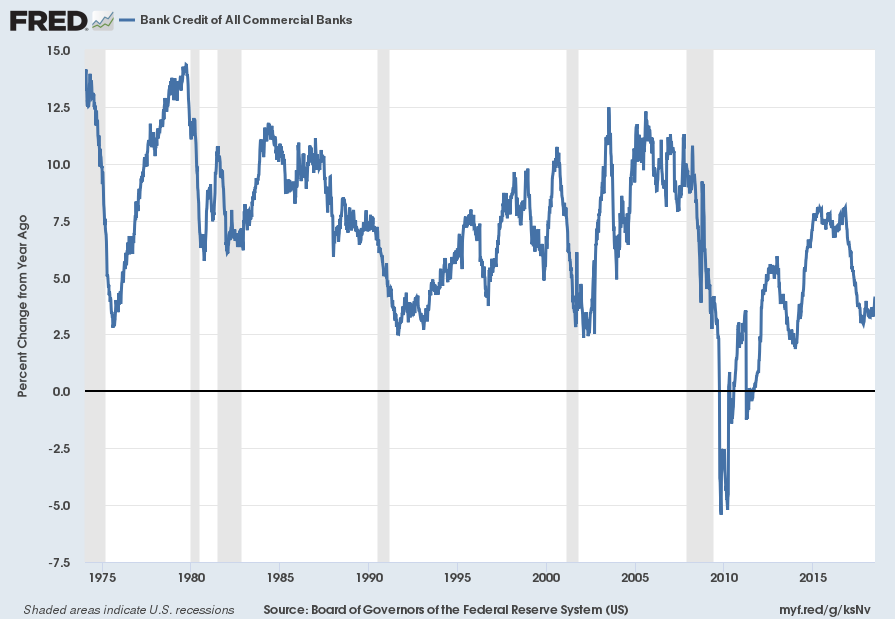

Bank Credit – All Commercial Banks (% Change from Year Ago)(last updated July 6, 2018):

Board of Governors of the Federal Reserve System (US), Bank Credit of All Commercial Banks [TOTBKCR], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/TOTBKCR/, July 13, 2018.

–

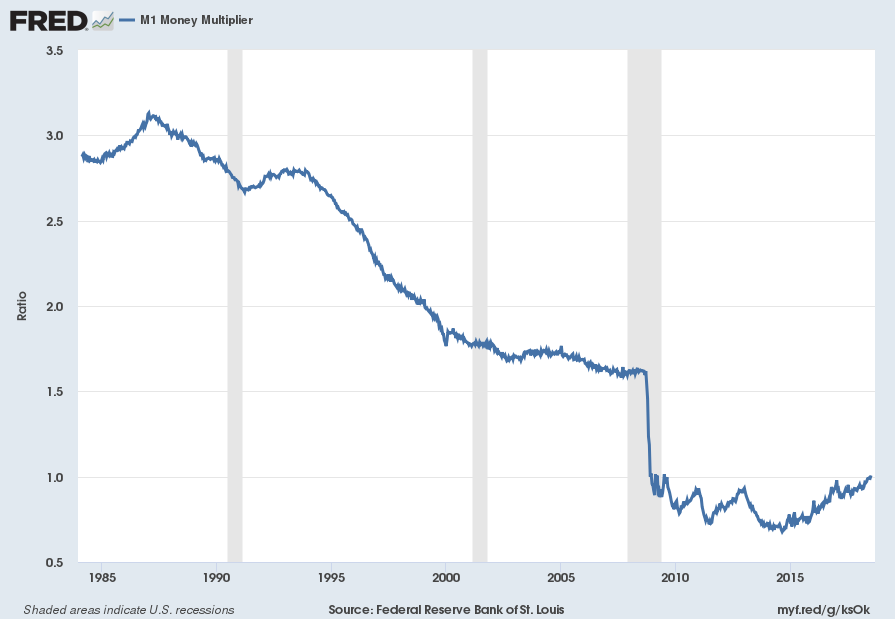

M1 Money Multiplier (last updated July 12, 2018):

Federal Reserve Bank of St. Louis, M1 Money Multiplier [MULT], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/MULT/, July 13, 2018.

–

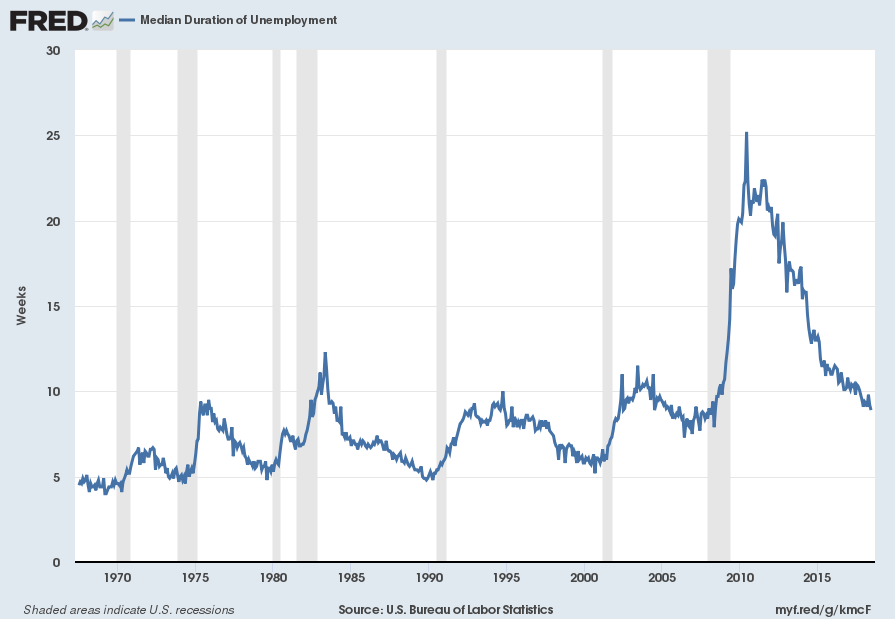

Median Duration of Unemployment (last updated July 6, 2018):

US. Bureau of Labor Statistics, Median Duration of Unemployment [UEMPMED], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/UEMPMED/, July 6, 2018.

–

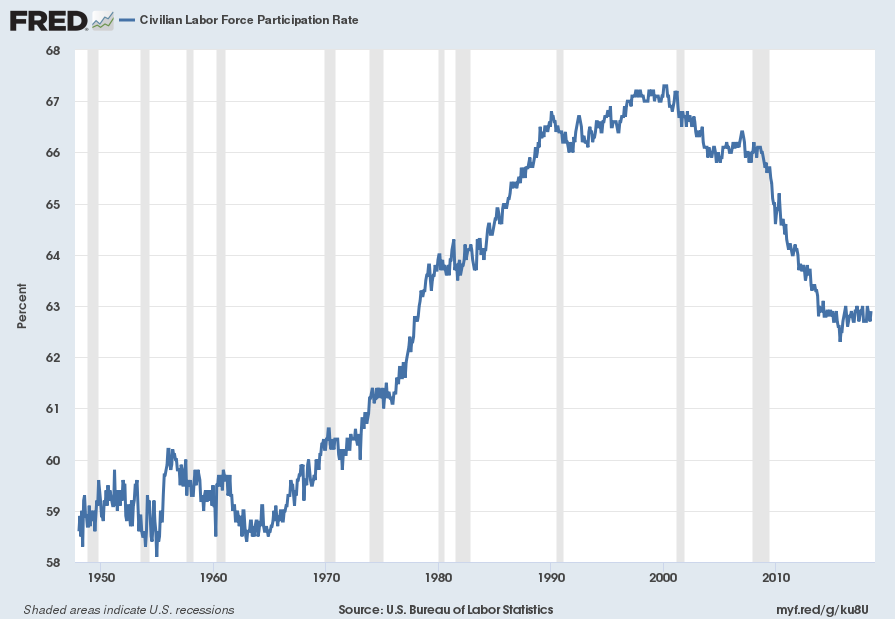

Labor Force Participation Rate (last updated July 6, 2018):

US. Bureau of Labor Statistics, Civilian Labor Force Participation Rate [CIVPART], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/CIVPART/, July 15, 2018.

–

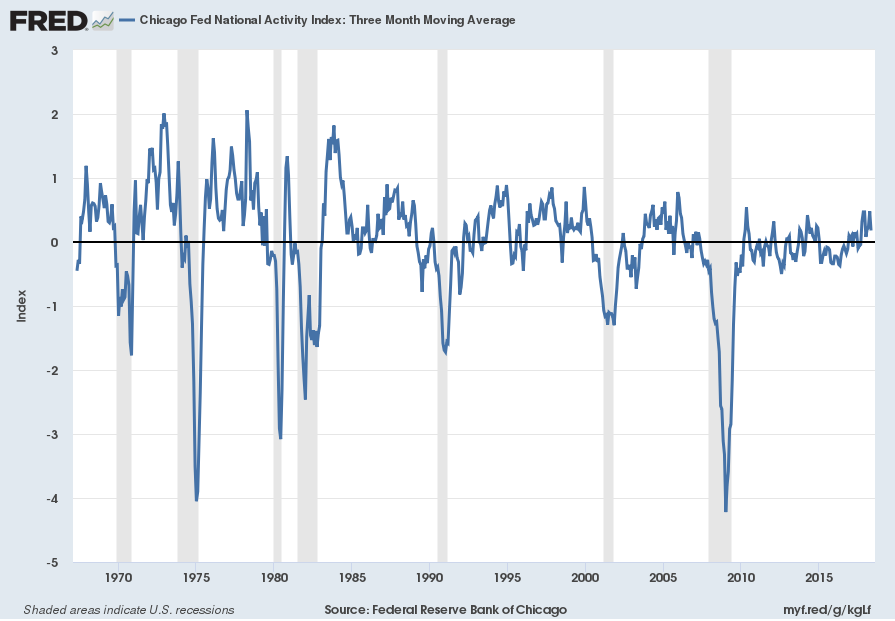

The Chicago Fed National Activity Index (CFNAI) 3-month moving average (CFNAI-MA3)(last updated June 25, 2018):

Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/CFNAIMA3/, June 25, 2018.

–

I will continue to update these charts on an intermittent basis as they deserve close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2801.31 as this post is written