Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

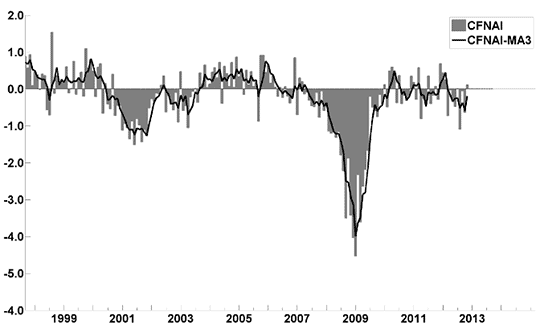

The December Chicago Fed National Activity Index (CFNAI)(pdf) updated as of December 21, 2012:

–

The ECRI WLI (Weekly Leading Index):

As of 12/21/12 (incorporating data through 12/14/12) the WLI was at 127.2 and the WLI, Gr. was at 4.6%.

A chart of the WLI, Gr. since 2000, from Doug Short’s blog of December 21 titled “ECRI Weekly Leading Index: The Recession Call Is Further Undermined” :

–

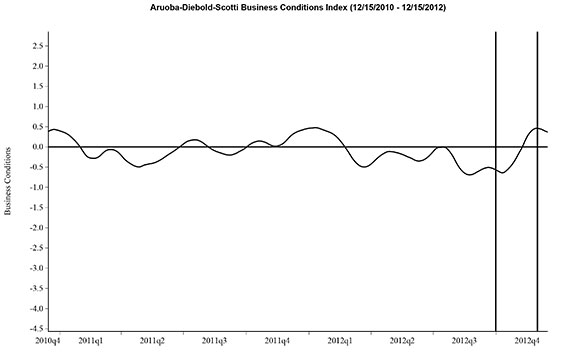

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 12-15-10 to 12-15-12:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the December 20 press release, the LEI was at 95.8 and the CEI was at 104.9 in November.

An excerpt from the December 20 release:

Says Ken Goldstein, economist at The Conference Board: “The indicators reflect an economy that remains weak in the face of strong domestic and international headwinds, as it faces a looming fiscal cliff. Growth will likely be slow through the early months of 2013.”

Here is a chart of the LEI from Doug Short’s blog post of December 20 titled “Conference Board Leading Economic Index: Six-Month Growth at Zero” :

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1430.15 as this post is written