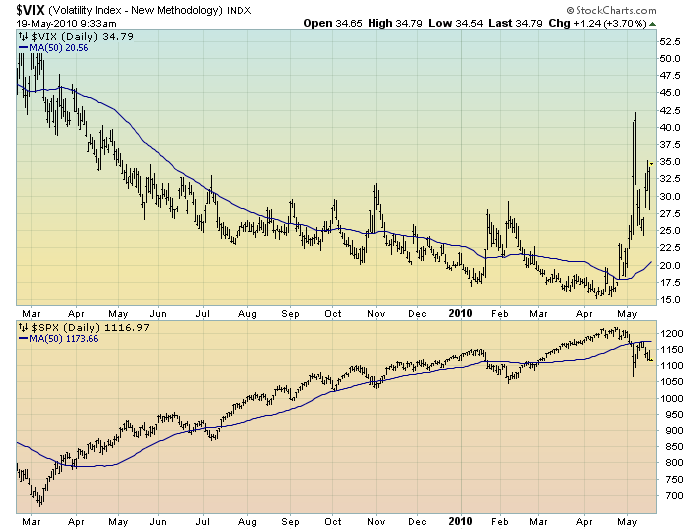

As seen in the chart below, the 50 day moving average (as seen in blue) for the VIX is now trending higher. This is the first time since March 2009 in which it has done so in a significant manner:

chart courtesy of StockCharts.com

Of course, there are many different ways to measure volatility. Other measures are showing a significant increase as well.

I expect there to be significant, and steadily increasing (relative to the past 15 months) volatility going forward. This will be seen in both up and down price movements.

This volatility is being caused by a variety of factors.

I believe that we are building to a variety of major market events. I will be elaborating upon this shortly.

back to <home>

SPX at 1116.65 as this post is written