On December 26, the Zillow December 2012 Home Price Expectations Survey (pdf) results were released. This survey is done on a quarterly basis.

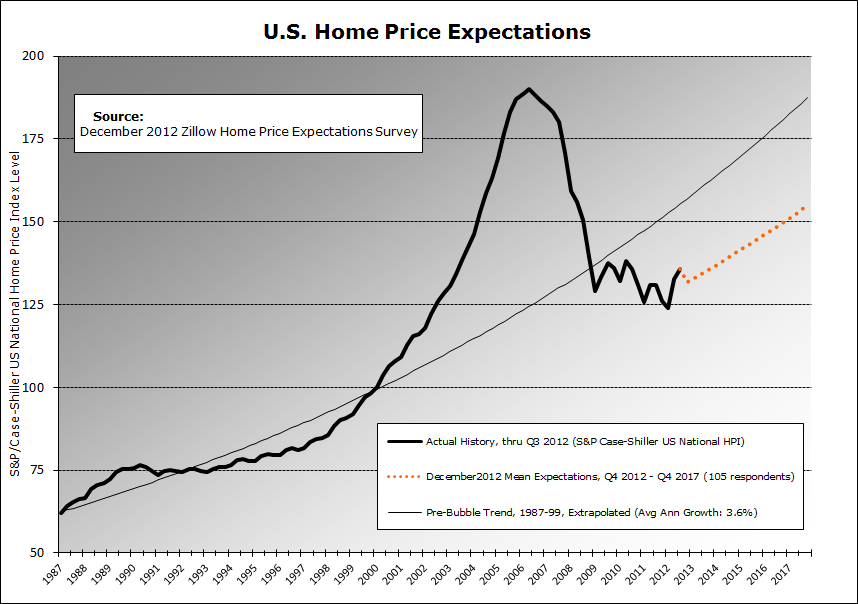

An image from the December 2012 Survey results is seen below:

(click on chart image to enlarge)

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the Case-Shiller US National Home Price Index (NSA), will continually climb after 2012.

The detail of the December 2012 Home Price Expectations Survey (pdf) is interesting. Of the 105 survey respondents, 4 (of the displayed responses) forecast a cumulative price decrease through 2017; and of those 4, only 2, William Hummer and Gary Shilling, foresee a double-digit percentage cumulative price drop, at 13.13% and 11.87%, respectively.

The Median Cumulative Home Price Appreciation for years 2012-2017 is seen as 4.60%, 8.12%, 11.94%, 15.86%, 19.42%, and 23.67%, respectively.

For a variety of reasons, I continue to believe that even the most “bearish” of these forecasts (as seen in William Hummer’s above-referenced forecast) will prove too optimistic in hindsight. Although a 13.13% cumulative decline is substantial, from a longer-term historical perspective such a decline is rather tame in light of the wild excesses that occurred over the “bubble” years.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, (even) from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately. I discussed this downside, based upon historical price activity, in the October 24, 2010 post titled “What’s Ahead For The Housing Market – A Look At The Charts.”

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1419.83 as this post is written