U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. At this time, the readings of various indicators are especially notable. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

While many U.S. economic indicators – including GDP – are indicating economic growth, others depict (or imply) various degrees of weak growth or economic contraction. As seen in the April 2018 Wall Street Journal Economic Forecast Survey the consensus among various economists is for 2.8% GDP growth in 2018. However, there are other broad-based economic indicators that seem to imply a weaker growth rate. There has been a significant lowering of estimates for 1st Quarter GDP growth as seen in the Federal Reserve Bank of Atlanta’s GDP Now (April 16, 2018 estimate of 1.9%) releases.

As well, it should be remembered that GDP figures can be (substantially) revised.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

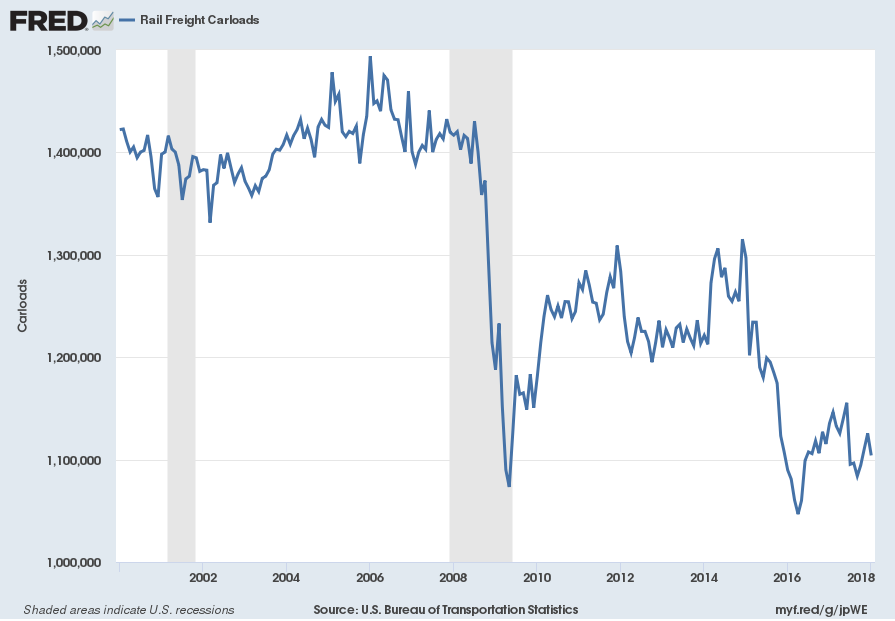

Rail Freight Carloads

“Rail Freight Carloads” continues to show a downward progression. Shown below is a chart with data through January (last value of 1,104,080, updated March 21, 2018):

source: U.S. Bureau of Transportation Statistics, Rail Freight Carloads [RAILFRTCARLOADSD11], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 11, 2017:

https://fred.stlouisfed.org/series/RAILFRTCARLOADSD11

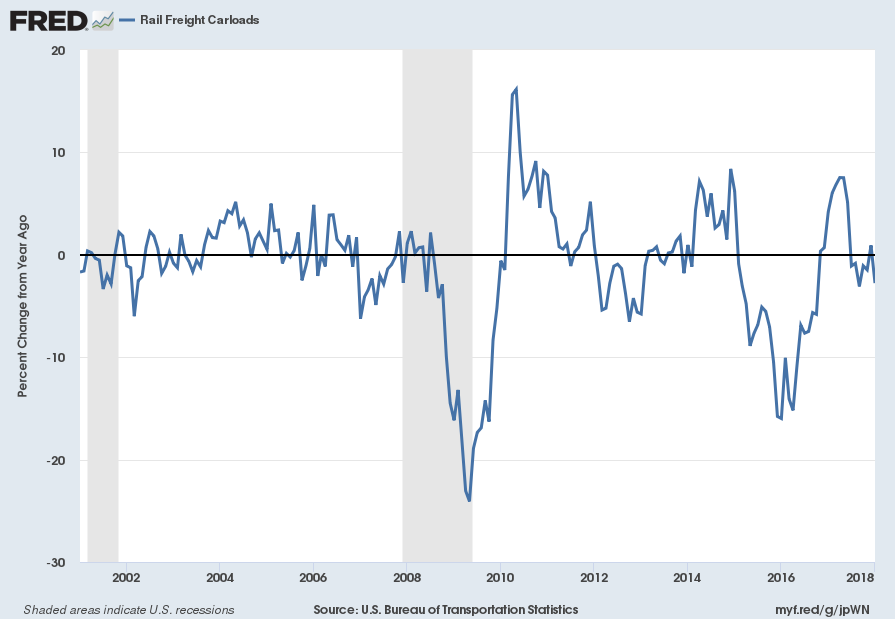

Here is the same measure on a “Percent Change From Year Ago” basis, with value -2.8%:

__

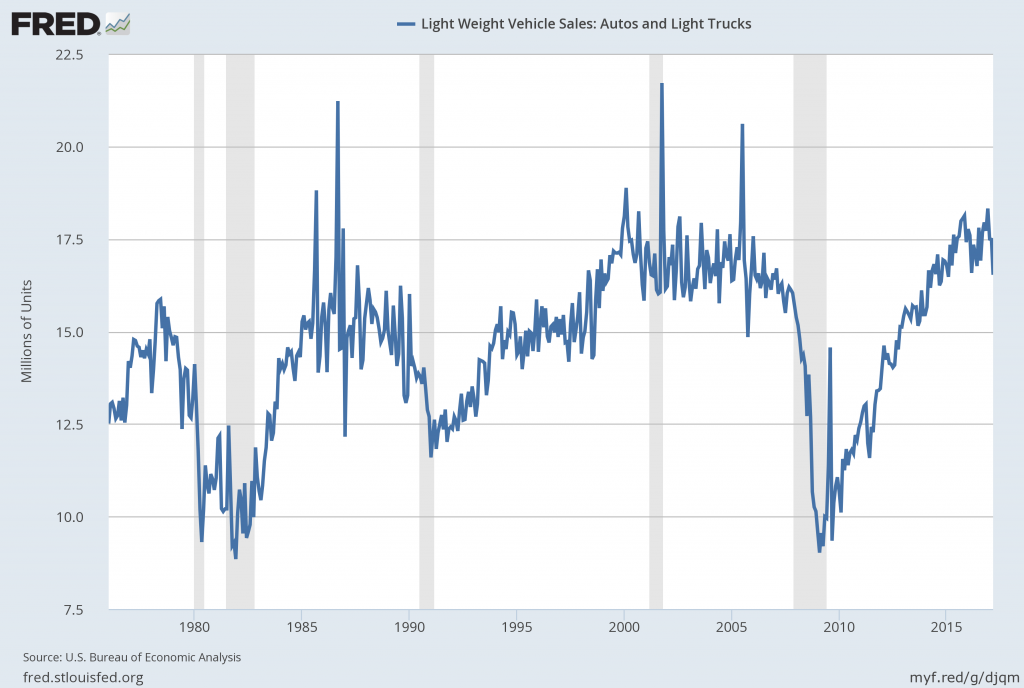

Auto Sales

Auto sales have experienced significant growth over the post-2009 period. The current reading (through February, updated on March 29) is 16.962 million vehicles:

source: U.S. Bureau of Economic Analysis, Light Weight Vehicle Sales: Autos and Light Trucks [ALTSALES], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 11, 2018:

https://fred.stlouisfed.org/series/ALTSALES

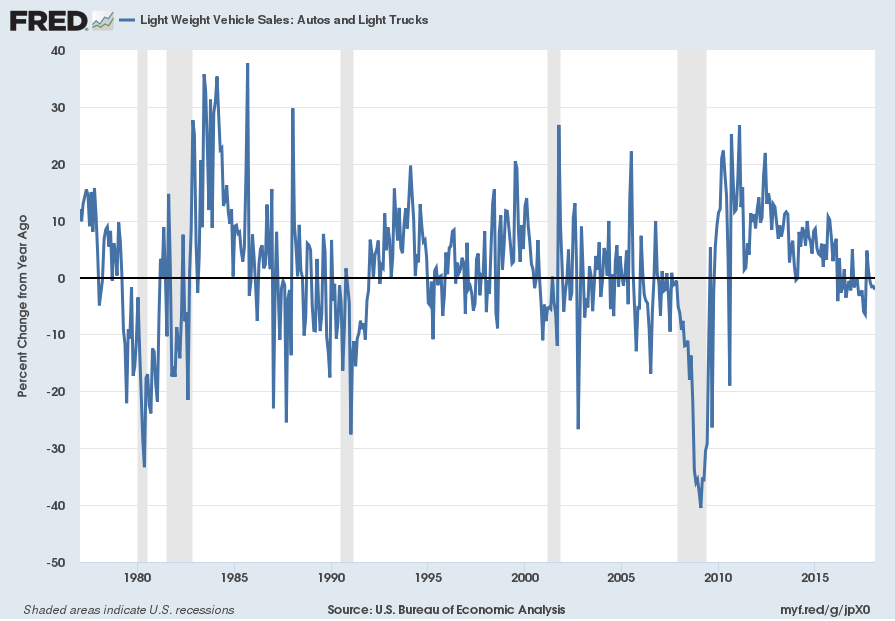

Here is the same measure on a “Percent Change From Year Ago” basis, with value -2.1%:

I believe that many factors indicate that auto sales have peaked. While this peaking will have vast economic implications, there are many other factors concerning auto sales that are worrisome. While an exhaustive discussion of the topic would be exceedingly lengthy, various notable factors include the degree to which (ultra-) cheap financing and relaxed financing terms are aiding sales, as well as various aspects of pricing and discounting.

__

Total Federal Receipts

“Total Federal Receipts” growth continues to be intermittent in nature since 2015. As well, the level of growth does not seem congruent to the (recent) levels of economic growth as seen in aggregate measures such as Real GDP.

“Total Federal Receipts” through March had a last value of $210,832 Million. Shown below is displayed on a “Percent Change From Year Ago” basis with value -2.7%, last updated April 12, 2018:

source: U.S. Department of the Treasury. Fiscal Service, Total Federal Receipts [MTSR133FMS], retrieved from FRED, Federal Reserve Bank of St. Louis, accessed April 12, 2018:

https://fred.stlouisfed.org/series/MTSR133FMS

__

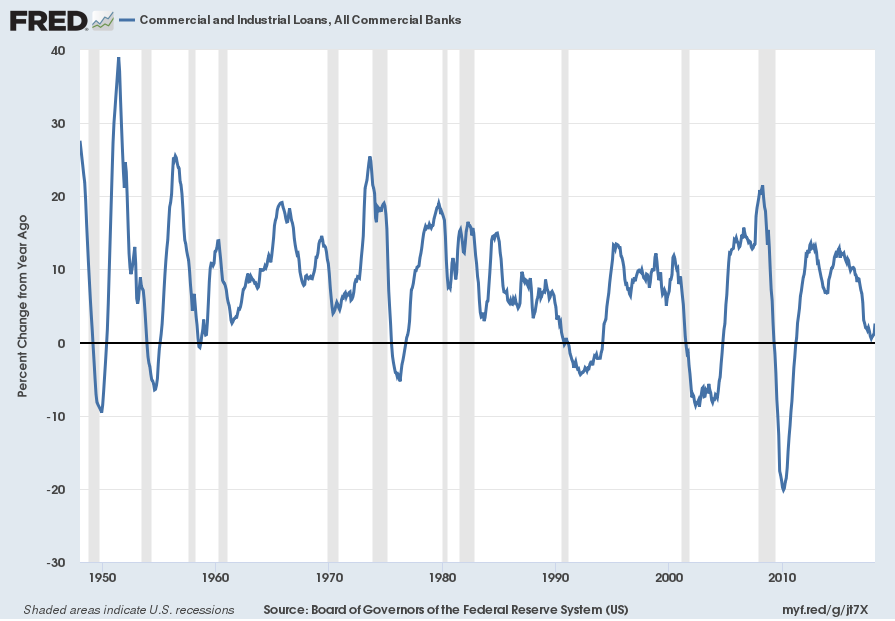

Commercial And Industrial Loans, All Commercial Banks

“Commercial And Industrial Loans, All Commercial Banks” through March had a last value of $2138.4559 Billion. The growth in such loans continues to decline. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with value 2.6%, last updated April 13, 2018:

source: Board of Governors of the Federal Reserve System (US), Commercial and Industrial Loans, All Commercial Banks [BUSLOANS], retrieved from FRED, Federal Reserve Bank of St. Louis April 16, 2018:

https://fred.stlouisfed.org/series/BUSLOANS

__

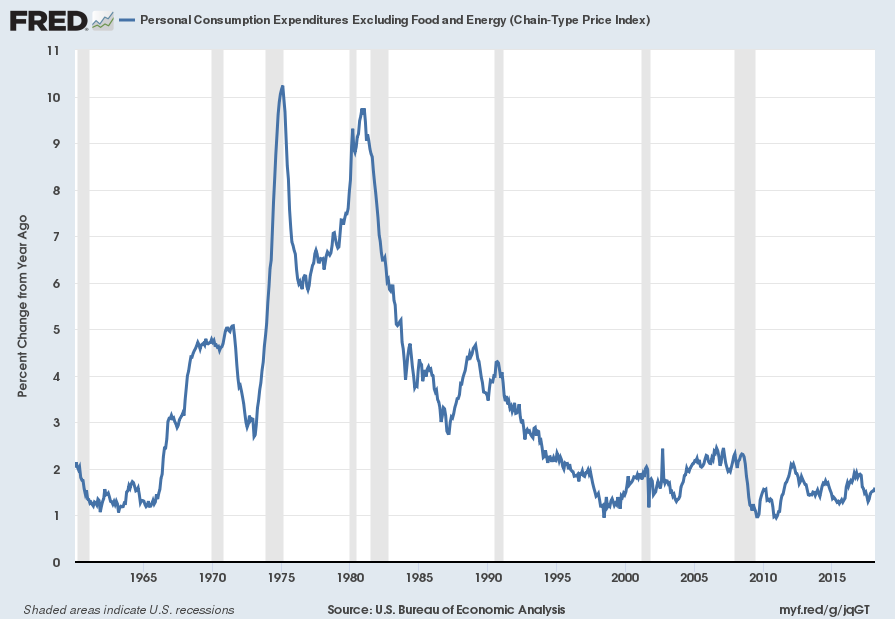

Inflation Trends

Although there has been widespread recent concern about impending inflation, as well as indications of higher inflation in some price measures, I continue to believe that deflation (as defined by when the CPI goes below zero) will occur.

Current inflation levels and the possibility of deflation is a vastly complex topic, and as such isn’t suitably discussed in a brief manner. I have discussed the issue of deflation extensively as it will have critical and wide-ranging economic implications. As I have stated in past commentaries, my analyses indicate that surveys or “market-based” measures concerning deflation will not provide adequate “advance warning” of this deflation.

For reference, here is the “Core PCE” measure as of the March 29, 2018 update, showing data through February, with a current reading on a “Percent Change From Year Ago” basis of 1.6%:

source: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index) [PCEPILFE], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 12, 2018:

https://fred.stlouisfed.org/series/PCEPILFE

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate economic weakness or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2677.84 as this post is written