U.S. Dollar weakness is a foremost concern of mine. As such, I have extensively written about it. I am very concerned that the actions being taken to “improve” our economic situation will dramatically weaken the Dollar. Should the Dollar substantially decline from here, as I expect, the negative consequences will far outweigh any benefits. The negative impact of a substantial Dollar decline can’t be overstated, in my opinion.

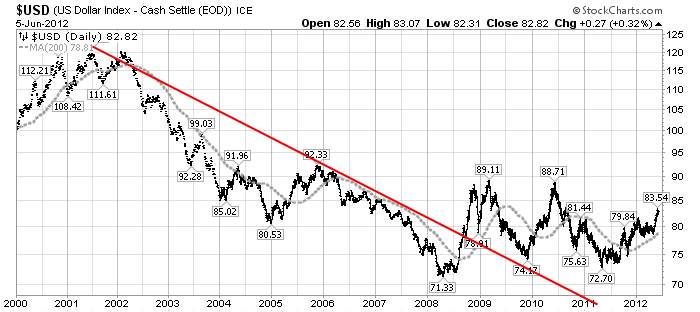

The following three charts illustrate various technical analysis aspects of the U.S. Dollar, as depicted by the U.S. Dollar Index.

First, a look at the monthly U.S. Dollar from 1983. This clearly shows a long-term weakness, with the blue line showing technical support (until 2007):

(charts courtesy of StockCharts.com; annotations by the author)

(click on charts to enlarge images)

–

Next, another chart, this one focused on the daily U.S. Dollar since 2000 on a LOG scale. The red line represents both a trendline as well as a relatively good visual “best-fit” line. The gray dotted line is the 200-day M.A. (moving average):

–

Lastly, a chart of the Dollar on a weekly LOG scale. There are some clearly marked channels here, with a potential large, prominent triangle featured (shown with two potential lower trendlines, one red and one dashed light blue line):

–

I will continue providing updates on this U.S. Dollar situation regularly as it deserves very close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1295.04 as this post is written

May I respectfully take a different position?

I love the declining dollar, and here’s why:

Compared to other countries, a lower dollar makes our wages look lower. Employers therefore move plants to this country. This brings investment, but much more: it also brings jobs and training to do those jobs. A low dollar therefore is good for us.

A low dollar makes exports more competitive price-wise. This of course leads to more production, which in turns creates jobs, investment and every things that makes an economy healthy. Again, a low dollar helps us.

Remember the Japanese miracles of a few decades ago? I would argue that was more driven by their low currency than any other single factor. It’s no coincidence that ever since the yen was allowed (forced?) to reflect a more accurate valuation, Japan’s competitiveness has disappeared and their exceptional growth disappeared.

Likewise, China’s recent growth was spurred significantly by their conscious attempts to keep their currency as low as possible, which makes their exports very price competitive.

India’s surge as an outsourcing center was driven by the fact that call centers there were cheaper. Idf the dollar drops, all those call centers come right back here, where they belong in the first place.

If an economy with jobs, investment and exports is of any value, a lower dollar is nothing but good news. The White House, always wanting to look good, even jumped on this benefit:

http://www.whitehouse.gov/blog/2012/01/11/everything-you-need-know-about-insourcing

Therefore, while I agree with some of your points, I believe the overall U.S. economy (specifically investment, employment, exports) is far better off with a weaker dollar than a stronger one.