In this post I would like to highlight various areas which I believe indicate excessively positive sentiment and problematical technical analysis measures in the stock market.

While the full list is extensive, I believe the list below represents a “sample” of how there is a high level of “frothiness” and other excess in the markets, which is a dangerous condition.

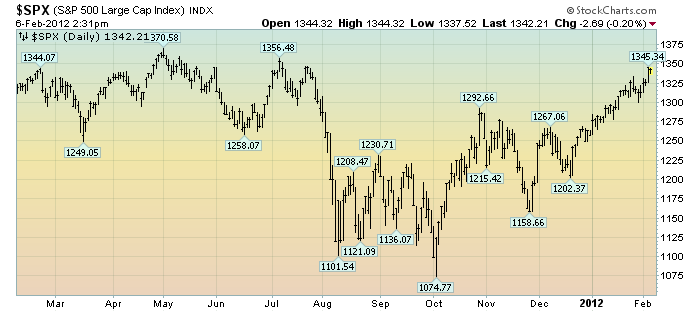

The stock market, as well as other financial markets, have been on a “tear” since the October 4 low of 1074.77 on the S&P500. This price action has been especially frenetic since the start of 2012. This is illustrated in a 1-year daily chart of the stock market :

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

One item that stands out is the large spread between the VIX and VIX Futures. As of this morning, the VIX stood at 17.80, while the March VIX futures were at 20.55, the June VIX futures were at 25.10, and the August futures were at 26.50. This spread is outsized and is one “red flag.”

I have in the past commented upon the VIX level of 20 as being significant in itself, and it continues to be an important demarcation.

Additionally, the SentimenTrader.com site had various statistics of note in the Friday evening comments of last week. As seen in that note, the list of extremes that were bearish (i.e. skewed too highly bullish) for the market was very extensive, with 31 listed. This high imbalance of indicators has been persistent since roughly mid-December.

In the comments, I found these to be especially notable :

An index that looks at various methods of hedging shows that there is very little of it going on. The Equity Hedging Index has dropped to one of the lowest levels in a decade.

also:

Commercial hedgers in stock index futures have gone net short several major indexes to nearly the largest degree in nine years.

also:

A surge in buying pressure today took the short-termIntraday Cumulative TICK for the Nasdaq to its 2nd-highest reading in 5 years. The highest was +11800 on 10/27/11 (the Nasdaq corrected over the next few weeks).

Another measure that is highly extended is the percentage of NYSE stocks above their 50-day moving average (at 89.32 as of Friday’s close).

Other notable aspect includes the steep trajectory of the QQQ in 2012 (from the 2011 close of 55.83 to 61.93 currently), as well as the continuing trend of “hot” tech stock IPOs being launched at (at least) 10x revenues and very high earnings multiples.

While these extremes can persist and in some cases have persisted, for a while, they usually serve as a warning sign. These excessive sentiment and worrisome technical analysis indicators constitute a subset of what I have written concerning the building level of financial danger.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1343.09 as this post is written