In my April 27 post (“Reasons Behind Gold’s Ascent“) I outlined a variety of factors that I believed were driving Gold’s advance.

Point #4 on the list was “…an expectation of high future inflation.”

It should be also noted that the inverse of this condition – an expectation of deflation – can serve to depress Gold’s price.

This is particularly noteworthy at present, as Gold has recently started a correction after a very steep rally. I am very closely monitoring Gold as I believe a steep, abnormal correction could serve to (further) indicate deflationary pressures – which of course would have outsized impacts on financial markets, the economy, and economic policy (particularly QE3 or some other large intervention.)

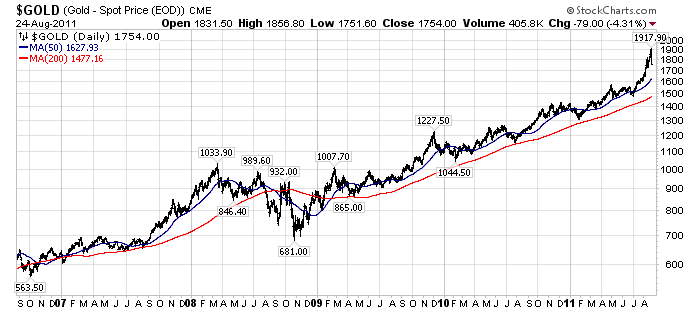

For reference, here is the daily Gold price chart for the last 5 years, updated through yesterday, shown on a LOG scale with both the 50dma and 200dma lines as indicated:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; annotations by the author)

Gold at $1726/oz (December futures) at the time of this post

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1176.07 as this post is written