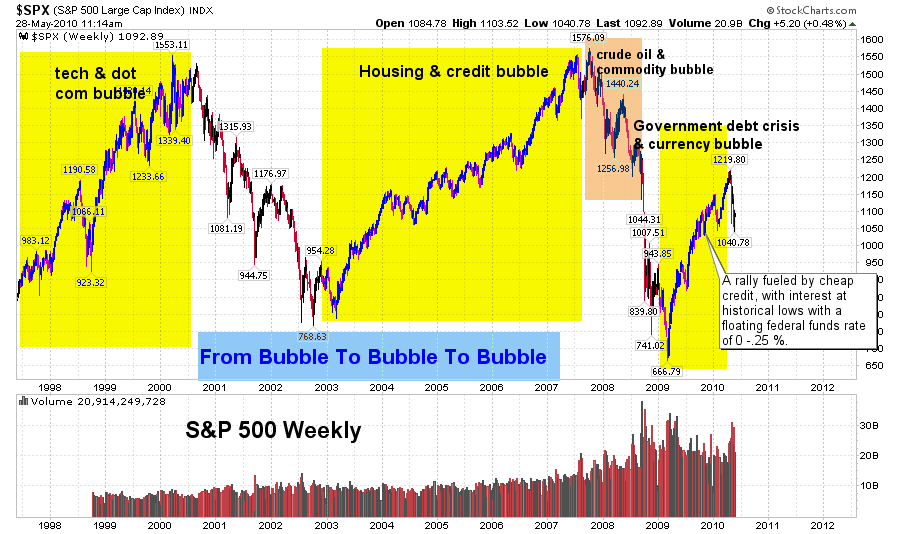

I ran across the following weekly S&P500 chart and comment from Maurice Walker, of thechartpatterntrader.com at StockCharts.com. Although I do not necessarily agree with all of the chart’s annotations and the accompanying commentary, I definitely think that both are worthy of contemplation:

chart courtesy of StockCharts.com

(one can click on the chart to enlarge the image)

Maurice Walker’s accompanying comment:

“The Keynesian Cure Never Works

The US had a massive malinestment (An investment in wrong lines which leads to capital losses. Malinvestment results from the inability of investors to foresee correctly, at the time of investment) in housing induced by affordable housing mandates, easy money from the Fed, and Fannie and Freddie guaranteeing mortgages that they had no business guaranteeing.

You cannot get over a debt infused recession with more debt. You have to work off the malinvestment. This is why the Keynesian cure never works. Just look at Greece.

But instead of working off the malivestment, we are trying reinflate the housing bubble with more spending. We are trying to reinflate the economic bubble with the stimulus package.

The Fed has to keep pressing the accelerator faster and faster to main tain the same simulative effect. But if the keep doing this it will cause inflation to arise. Additionally, the Fed already engineered a runaway expansion of the monetary base, that will generate explosive inflation. The borrowing needs of Obama’s record-shattering deficits will only exacerbate the effect. We are moving from a housing bubble to a government debt bubble that is going to ultimately collapse the dollar.”

_____

back to <home>

SPX at 1092.58 as this post is written