U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

The level and trend of economic growth is especially notable at this time. As seen in various measures and near-term projections, the U.S. economy had undergone an outsized level of economic contraction in 2020. However, most people believe (and virtually all prominent economic forecasts indicate) that this historic level of contraction will prove ephemeral in nature; i.e. a sustainable economic rebound will have started in the third quarter of 2020, followed by continual economic expansion.

As seen in the April 2021 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for 6.41% GDP growth in 2021, 3.21% GDP growth in 2022, and 2.39% GDP growth in 2023.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

Industrial Production (INDPRO)

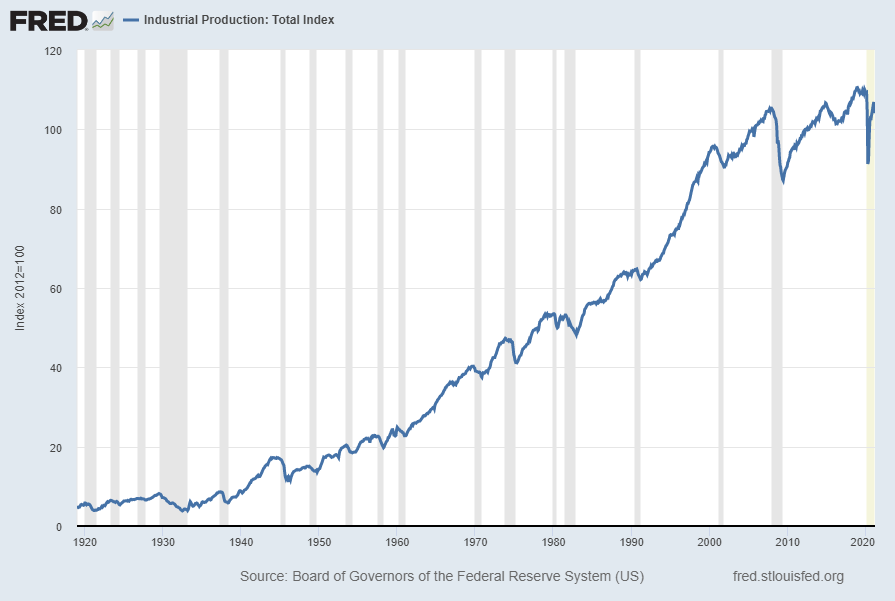

The “Industrial Production” measure is a measure that showed an outsized contraction followed by a (partial) rebound. Shown below is a long-term chart of this measure (displayed from 1919), with last value of 105.583 through March 2021, last updated April 15, 2021:

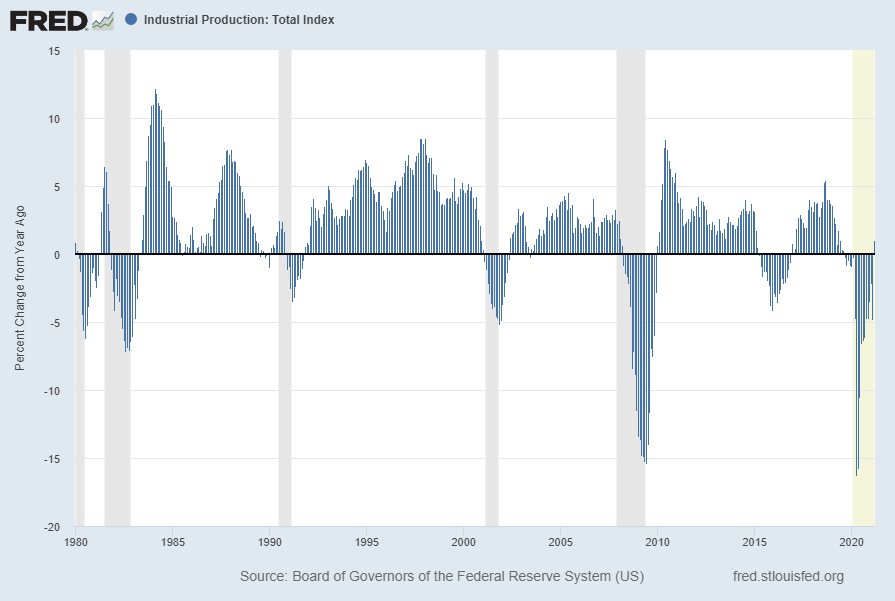

Displayed below is this same INDPRO measure from 1980 on a “Percent Change From Year Ago” basis with a value of 1.0%:

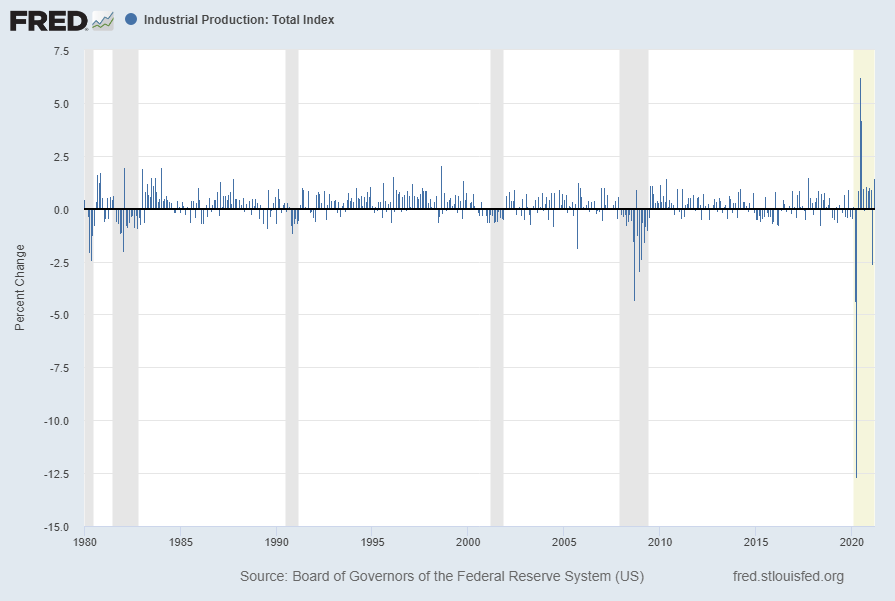

Displayed below is this same INDPRO measure from 1980 on a “Percent Change” basis with value 1.4%:

source: Board of Governors of the Federal Reserve System (US), Industrial Production [INDPRO], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 16, 2021: https://fred.stlouisfed.org/series/INDPRO

__

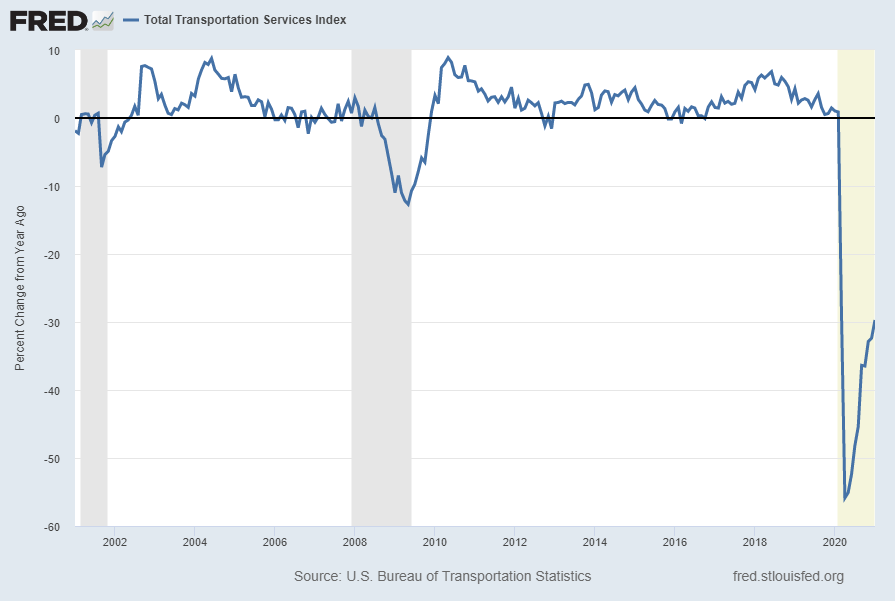

Total Transportation Services Index (TSITTL)

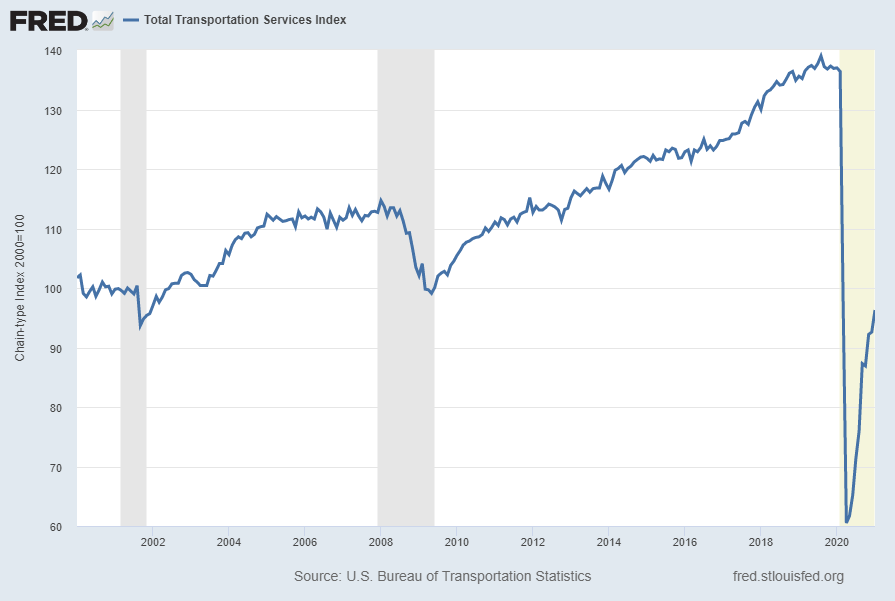

“Total Transportation Services Index” (TSITTL), like other transportation measures, is exhibiting recent substantial weakness. Shown below is this measure with last value of 96.3 through January, last updated April 14, 2021:

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -29.7%:

source: U.S. Bureau of Transportation Statistics, Total Transportation Services Index [TSITTL], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 16, 2021; https://fred.stlouisfed.org/series/TSITTL

__

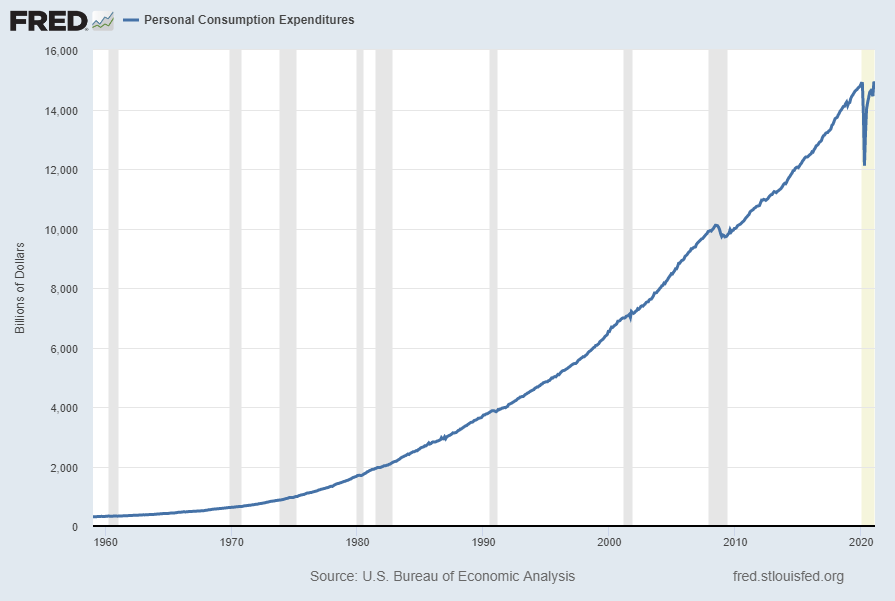

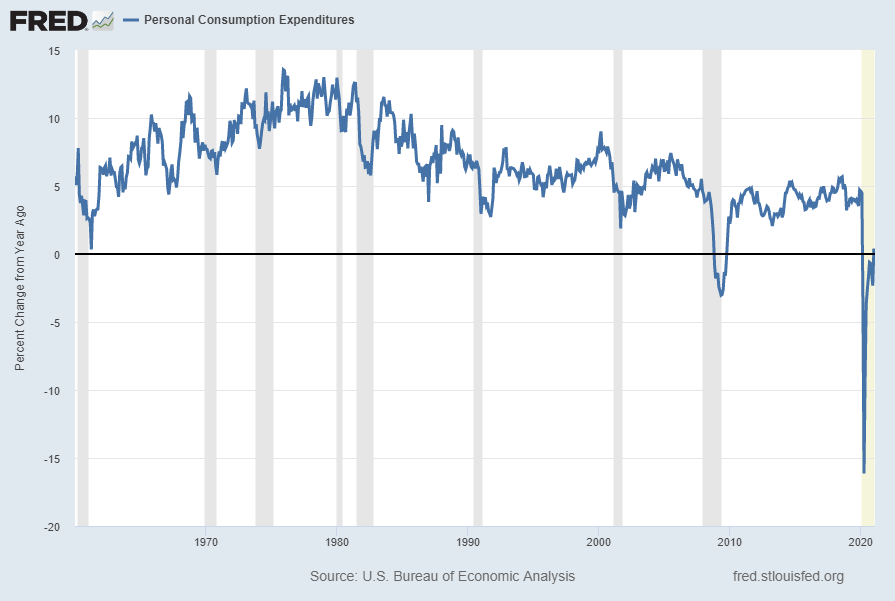

Personal Consumption Expenditures (PCE)

“Personal Consumption Expenditures” (PCE), has been rebounding after substantial weakness. Shown below is this measure with last value of $14,790.1 through February, last updated March 26, 2021:

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -.6%:

source: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures [PCE], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 16, 2021: https://fred.stlouisfed.org/series/PCE

__

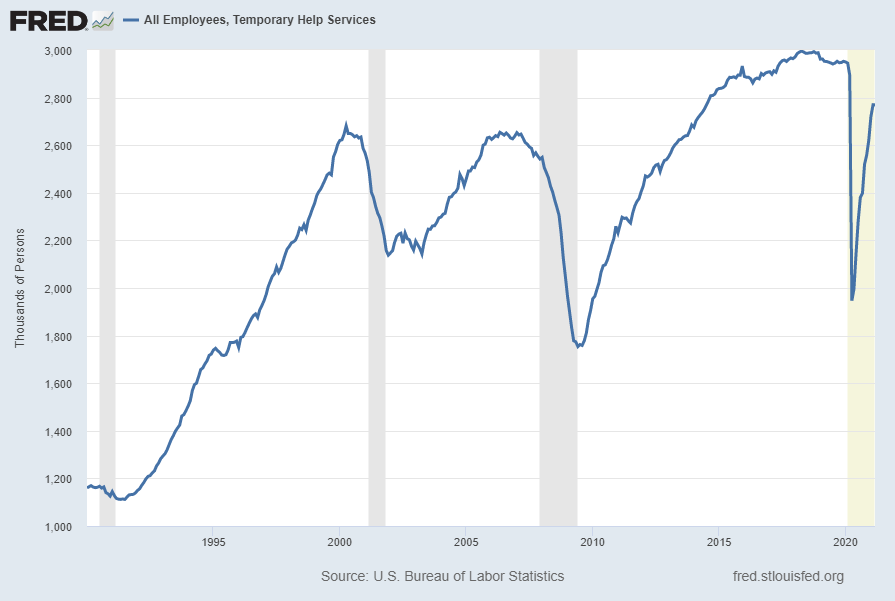

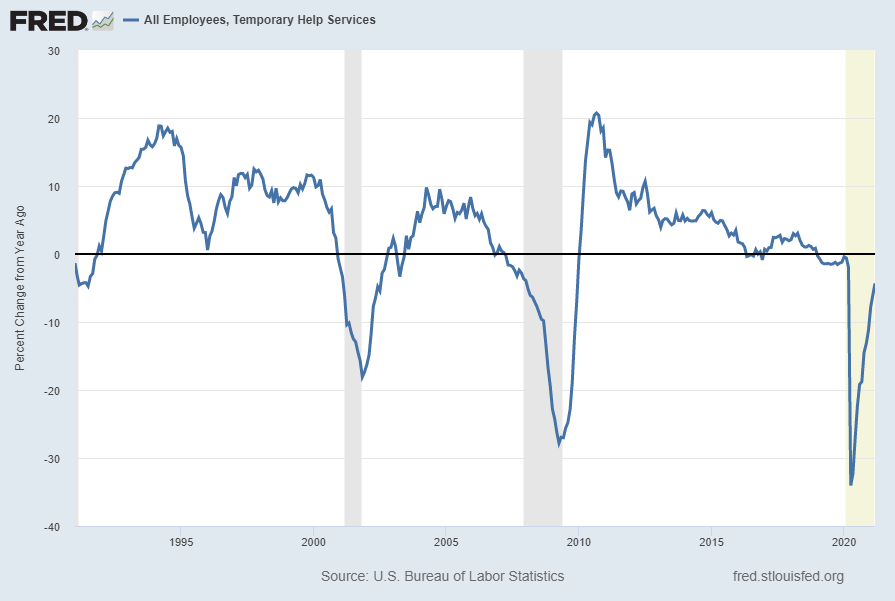

All Employees, Temporary Help Services (TEMPHELPS)

I have written extensively about many facets of employment and unemployment, as the current and future unemployment issue is of tremendous importance.

One theory regarding employment is that hiring cycles typically begin with an uptake in temporary employment.

Shown below is this measure with last value of 2,769.3 (Thousands) through March, last updated April 2, 2021:

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -4.3%:

source: U.S. Bureau of Labor Statistics, All Employees, Temporary Help Services [TEMPHELPS], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 16, 2021: https://fred.stlouisfed.org/series/TEMPHELPS

__

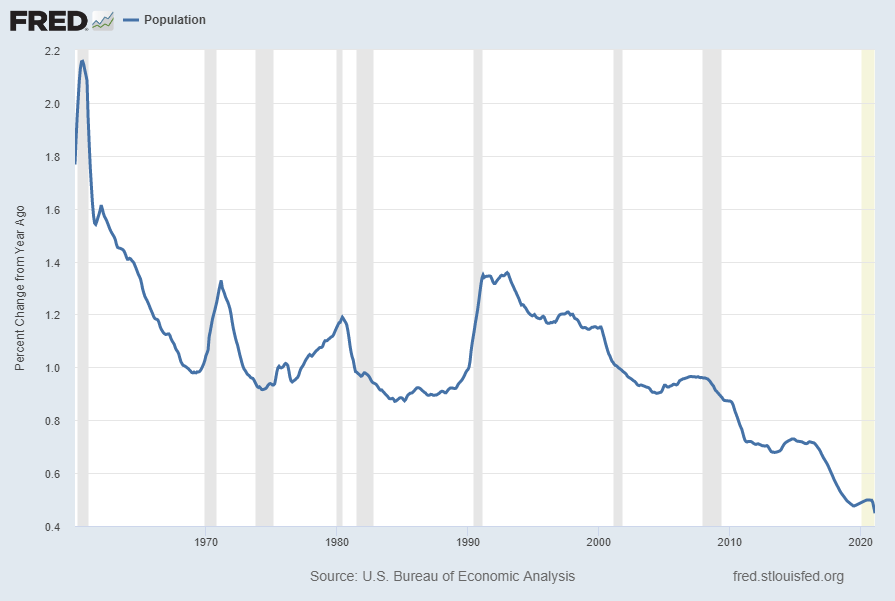

Population Growth (POPTHM)

Shown below is a long-term chart of U.S. population growth on a “Percent Change From A Year Ago” basis with value .4% through February 2021, as of the March 26, 2021 update. The declining nature of the growth rate is notable and may in itself deserve consideration as an economic indicator:

source: U.S. Bureau of the Census, Total Population: All Ages including Armed Forces Overseas [POP], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 16, 2021: https://fred.stlouisfed.org/series/POPTHM

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate slow economic growth or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4185.47 as this post is written