On Friday (March 20, 2020) I wrote a post (“Federal Reserve Actions To Address Financial And Economic Weakness“) detailing recently announced Federal Reserve actions intended to address various problematical conditions. These conditions include actual and expected substantial economic weakness, financial instability, and various rapidly falling asset prices.

In that post I also highlighted my thoughts on intervention efforts. I have written extensively about interventions of all types, including Quantitative Easing (QE) and past economic stimulus programs. Posts discussing intervention measures can generally be found in the “Interventions” category.

Early today (March 23, 2020) the Federal Reserve made additional announcements. Among those announcements was one regarding the amount of QE it will possibly do, as well as other newly enacted intervention programs.

The new announcement with regard to QE is discussed in this March 23 FOMC Statement. An excerpt:

The Federal Open Market Committee is taking further actions to support the flow of credit to households and businesses by addressing strains in the markets for Treasury securities and agency mortgage-backed securities. The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions. The Committee will include purchases of agency commercial mortgage-backed securities in its agency mortgage-backed security purchases. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations. The Committee will continue to closely monitor market conditions, and will assess the appropriate pace of its securities purchases at future meetings.

The paramount phrase is that the stated asset purchases will be done “in the amounts needed.” Most observers appear to interpret this as (potentially) “unlimited QE.”

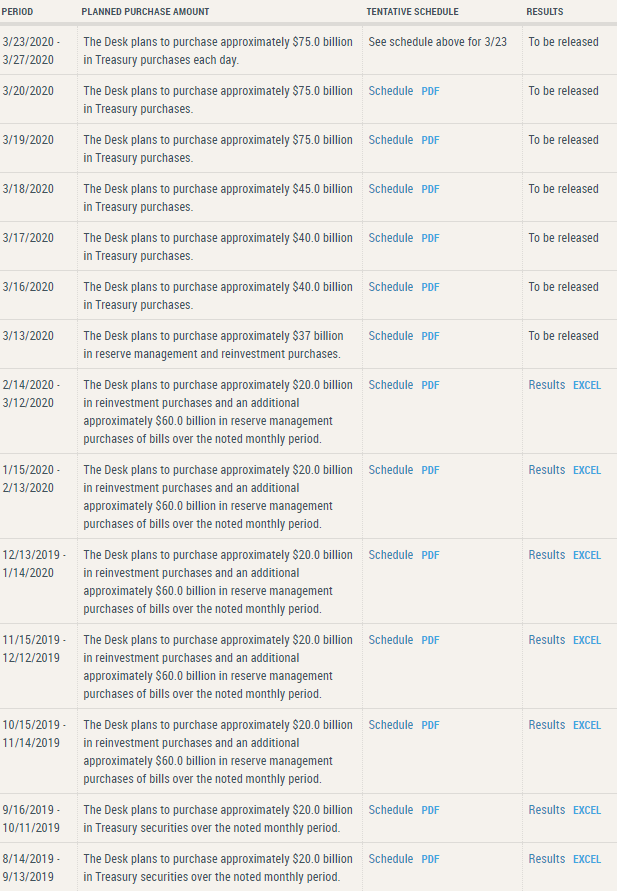

For reference, a schedule of past and planned Treasury purchases can be seen in the table below, from the Federal Reserve Bank of New York’s “Treasury Securities Operational Details” page:

Also, the planned MBS purchases, of $50B each day this week, are discussed in the March 23, 2020 “Statement Regarding Treasury Securities and Agency Mortgage-Backed Securities Operations” release.

As well, a separate announcement, titled “Federal Reserve announces extensive new measures to support the economy” lists other newly-announced programs. An excerpt (further explanation and details are seen in the press release):

- Supporting the flow of credit to employers, consumers, and businesses by establishing new programs that, taken together, will provide up to $300 billion in new financing. The Department of the Treasury, using the Exchange Stabilization Fund (ESF), will provide $30 billion in equity to these facilities.

- Establishment of two facilities to support credit to large employers – the Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds.

- Establishment of a third facility, the Term Asset-Backed Securities Loan Facility (TALF), to support the flow of credit to consumers and businesses. The TALF will enable the issuance of asset-backed securities (ABS) backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA), and certain other assets.

- Facilitating the flow of credit to municipalities by expanding the Money Market Mutual Fund Liquidity Facility (MMLF) to include a wider range of securities, including municipal variable rate demand notes (VRDNs) and bank certificates of deposit.

- Facilitating the flow of credit to municipalities by expanding the Commercial Paper Funding Facility (CPFF) to include high-quality, tax-exempt commercial paper as eligible securities. In addition, the pricing of the facility has been reduced.

_____

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2270.23 as this post is written