U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. At this time, the readings of various indicators are especially notable. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

While many U.S. economic indicators – including GDP – are indicating economic growth, others depict (or imply) various degrees of weak growth or economic contraction. As seen in the December 2018 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for 3.1% GDP growth in 2018 and 2.3% GDP growth in 2019. However, there are other broad-based economic indicators that seem to imply a weaker growth rate.

As well, it should be remembered that GDP figures can be (substantially) revised.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

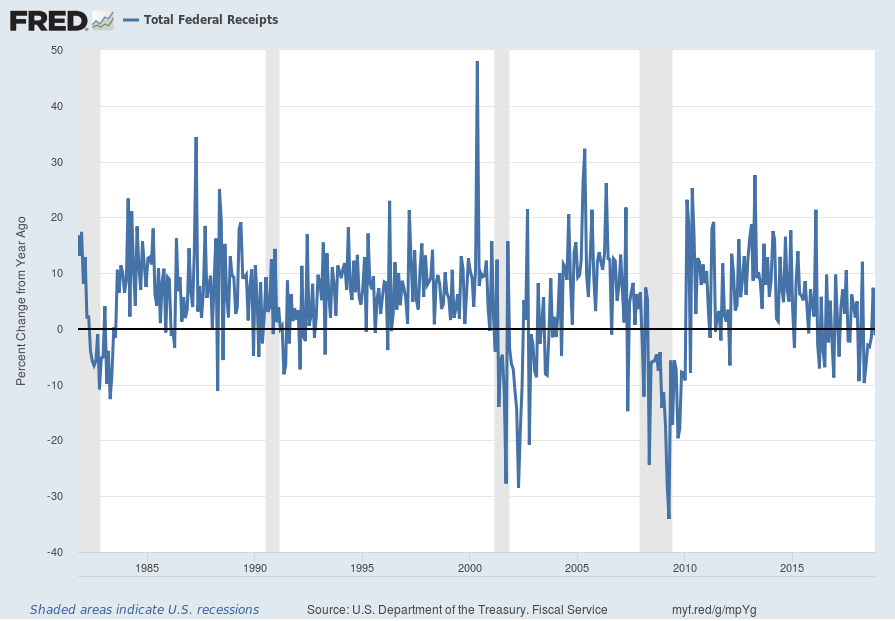

Total Federal Receipts

“Total Federal Receipts” growth continues to be intermittent in nature since 2015. As well, the level of growth does not seem congruent to the (recent) levels of economic growth as seen in aggregate measures such as Real GDP.

“Total Federal Receipts” through November had a last value of $205,961 Million. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with value -1.5%, last updated December 13, 2018:

source: U.S. Department of the Treasury. Fiscal Service, Total Federal Receipts [MTSR133FMS], retrieved from FRED, Federal Reserve Bank of St. Louis, accessed December 13, 2018:

https://fred.stlouisfed.org/series/MTSR133FMS

__

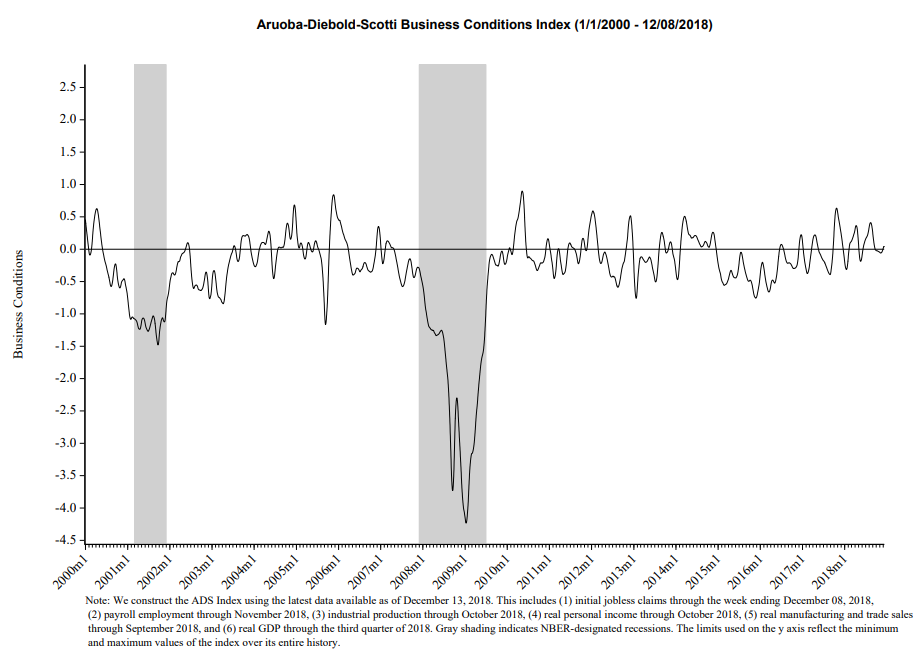

The Aruoba-Diebold-Scotti Business Conditions Index (ADS Index)

While the 3rd quarter GDP (Second Estimate)(pdf) was 3.5%, there are other broad-based economic indicators that seem to imply a weaker growth rate.

Among the broad-based economic indicators that seem to imply subdued or intermittent growth is that of the Aruoba-Diebold-Scotti Business Conditions Index (ADS Index.) Below is a chart of the index from the year 2000 through December 8, 2018, with a value of .0405, as of the December 13 update:

source: Federal Reserve Bank of Philadelphia, Aruoba-Diebold-Scotti Business Conditions Index (ADS Index)

__

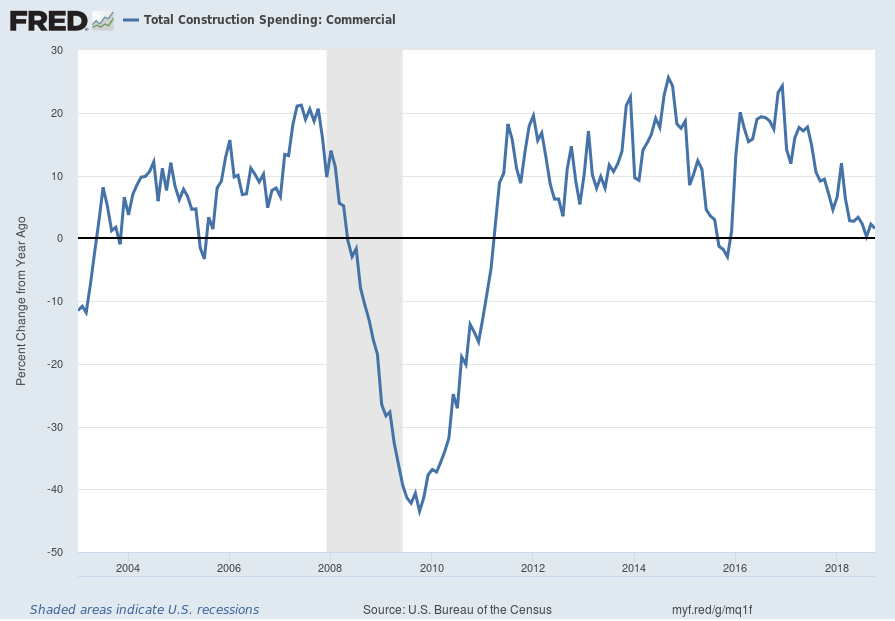

Total Construction Spending: Commercial

“Total Private Construction Spending: Commercial” is a measure of construction exhibiting weak YoY growth. This measure through October had a last value of $88,686 Million. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with a value of 1.6%, last updated December 3, 2018:

source: U.S. Bureau of the Census, Total Construction Spending: Commercial [TLCOMCONS], retrieved from FRED, Federal Reserve Bank of St. Louis, accessed December 13, 2018:

https://fred.stlouisfed.org/series/TLCOMCONS

__

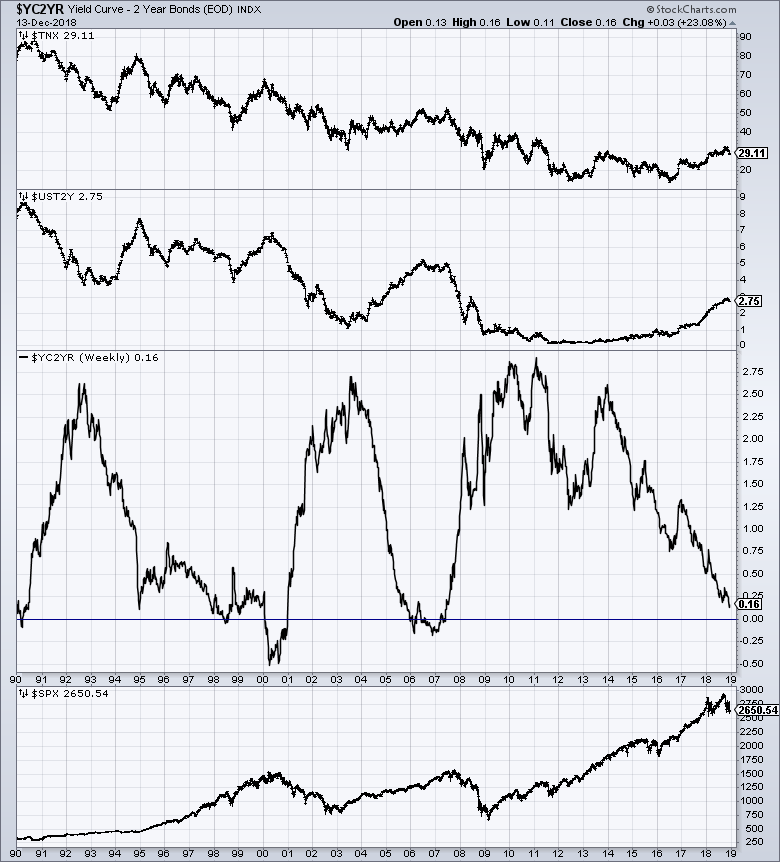

The Yield Curve

Many people believe that the Yield Curve is a leading economic indicator for the United States economy.

On March 1, 2010, I wrote a post on the issue, titled “The Yield Curve As A Leading Economic Indicator.”

While I continue to have the stated reservations regarding the “yield curve” as an indicator, I do believe that it should be monitored.

As an indication of the yield curve (i.e. a yield curve proxy), below is a weekly chart from January 1, 1990 through December 13, 2018. The top two plots show the 10-Year Treasury and 2-Year Treasury yields. The third plot shows the (yield) spread between the 10-Year Treasury and 2-Year Treasury, with the December 13, 2018 closing value of .16%. The bottom plot shows the S&P500:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

__

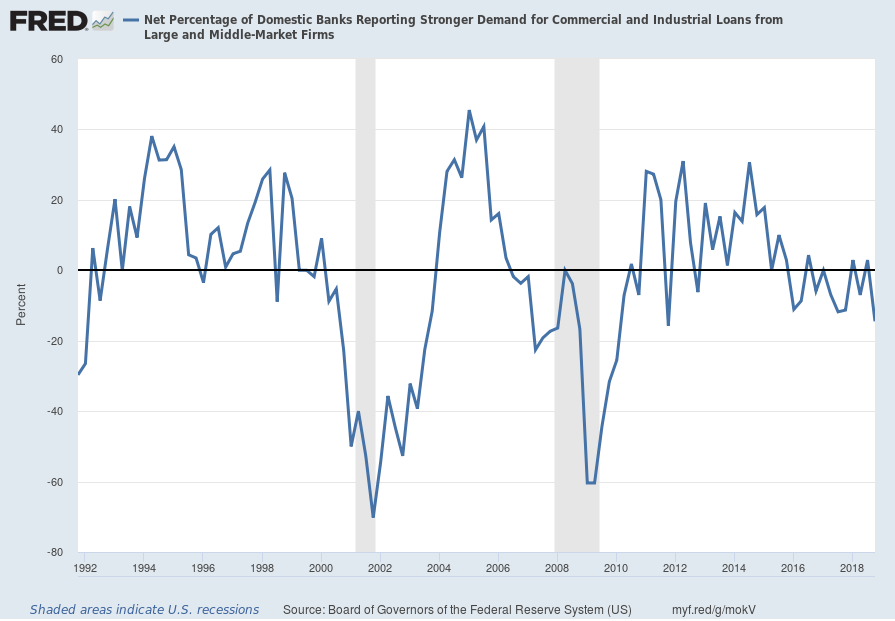

Loan Demand And Related Measures

As seen in previous updates, various aspects of lending growth and related measures have shown a marked slowing in the growth rate. Shown below is a measure, Net Percentage of Domestic Banks Reporting Stronger Demand for Commercial and Industrial Loans from Large and Middle-Market Firms, that shows a decline. The current value is -14.5% as of the November 14, 2018 quarterly update:

source: Board of Governors of the Federal Reserve System (US), Net Percentage of Domestic Banks Reporting Stronger Demand for Commercial and Industrial Loans from Large and Middle-Market Firms [DRSDCILM], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed December 11, 2018:

https://fred.stlouisfed.org/series/DRSDCILM

__

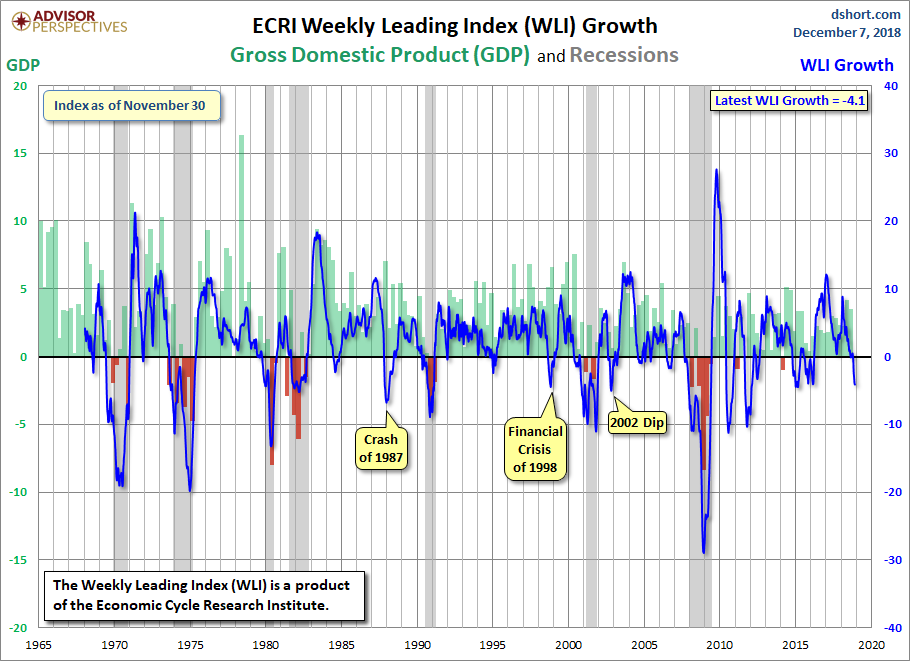

The ECRI WLI (Weekly Leading Index)

The ECRI WLI,Gr. measure has been declining and now is at -4.1% as of the December 7, 2018 update, reflecting data through November 30, 2018.

A chart of the WLI,Gr., with an overlay of U.S. GDP, from the Doug Short’s site ECRI update post of December 7, 2018:

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate weak economic growth or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2650.54 as this post is written