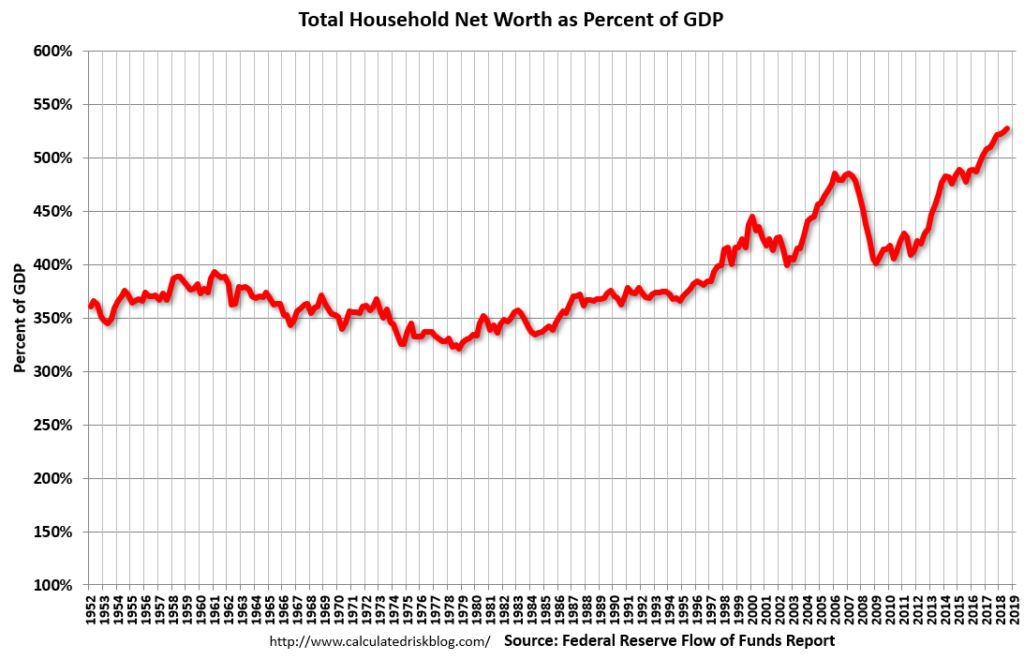

The following chart is from the CalculatedRisk post of December 6, 2018 titled “Fed’s Flow of Funds: Household Net Worth increased in Q3.” It depicts Total Household Net Worth as a Percent of GDP. The underlying data is from the Federal Reserve’s Z.1 report, “Financial Accounts of the United States“:

(click on chart to enlarge image)

As seen in the above-referenced CalculatedRisk post:

The net worth of households and nonprofits rose to $109.0 trillion during the third quarter of 2018. The value of directly and indirectly held corporate equities increased $1.2 trillion and the value of real estate increased $0.2 trillion.

also:

The Fed estimated that the value of household real estate increased to $25.4 trillion in Q3. The value of household real estate is now above the bubble peak in early 2006 – but not adjusted for inflation, and this also includes new construction.

As I have written in previous posts concerning this Household Net Worth (as a percent of GDP) topic:

As one can see, the first outsized peak was in 2000, and attained after the stock market bull market / stock market bubbles and economic strength. The second outsized peak was in 2007, right near the peak of the housing bubble as well as near the stock market peak.

also:

I could extensively write about various interpretations that can be made from this chart. One way this chart can be interpreted is a gauge of “what’s in it for me?” as far as the aggregated wealth citizens are gleaning from economic activity, as measured compared to GDP.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2664.37 as this post is written