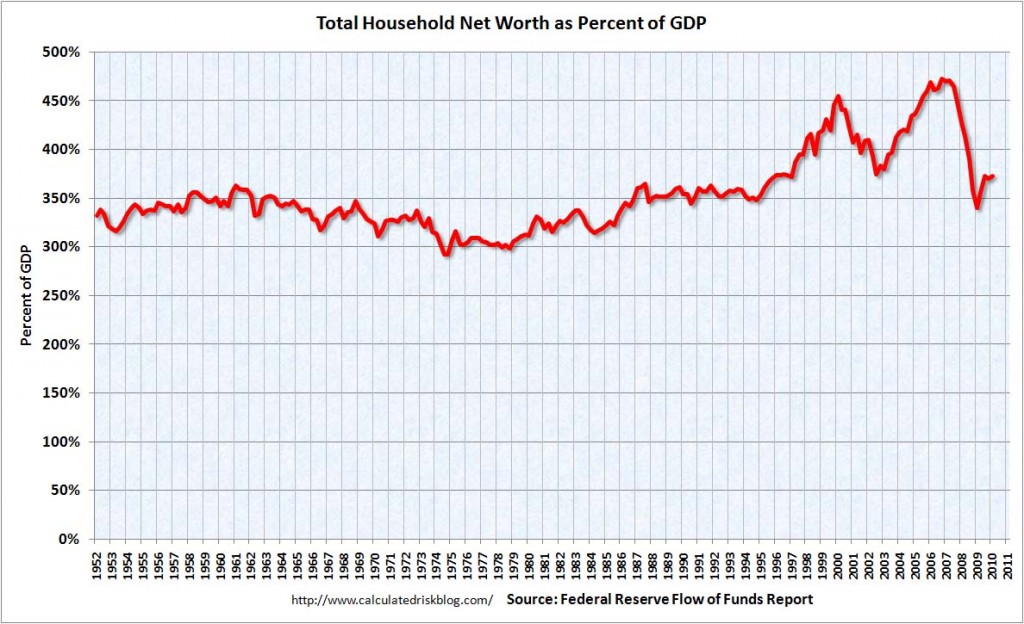

The following chart is from the CalculatedRisk Blog of June 10, 2010. It depicts Total Household Net Worth as a Percent of GDP. The underlying data is from The Federal Reserve Flow of Funds 1Q2010 report:

click on chart to enlarge image

As seen in the above-referenced CalculatedRisk blog post:

“According to the Fed, household net worth is now off $11.4 Trillion from the peak in 2007, but up $6.3 trillion from the trough in Q1 2009. A majority of the decline in net worth is from real estate assets with a loss of about $6.4 trillion in value from the peak. Stock market losses are still substantial too.”

My comments:

As one can see, the first outsized peak was in 2000, and attained after the stock market bull market / stock market bubbles and economic strength. The second outsized peak was in 2007, right near the peak of the housing bubble as well as near the stock market peak.

As seen on the chart, the Total Household Net Worth is making an upturn, but is significantly below the prior 2007 peak.

I could extensively write about various interpretations that can be made from this chart. One way this chart can be interpreted is a gauge of “what’s in it for me?” as far as the aggregated wealth citizens are gleaning from economic activity, as measured compared to GDP.

back to <home>

SPX at 1114.73 as this post is written