On August 22, 2013 I wrote a post titled “The Impact Of Rising Interest Rates,” in which I discussed various wide-ranging impacts of the rising interest rate environment that I believe lack recognition. In this post, I would like to make additional comments regarding the future level of interest rates, and specifically the 10-Year Treasury Note yield.

First, for reference, here is a long-term chart of the 10-Year Treasury yield from 1965, as seen in Doug Short’s post of November 29 titled “Treasury Yields In Perspective” :

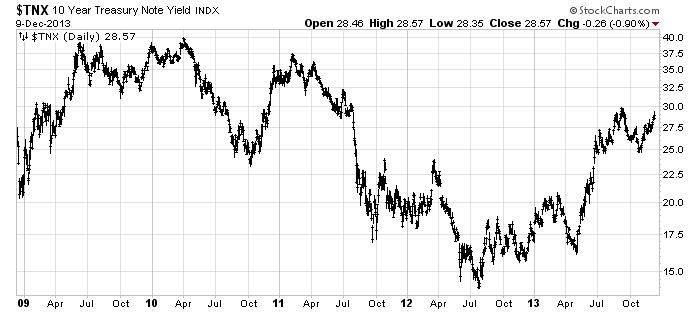

Second, for reference, is a daily 5-year chart of the 10-Year Treasury Note yield on a LOG scale, through December 9, with a current value of 2.857%. As one can see, recent resistance has been near the 3.0%-level:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

The November Wall Street Journal Economic Forecast Survey shows an average expectation of 10-year Treasury Note yields of 3.43% in December 2014 and 3.89% in December 2015. As well, many observers of interest rates have stated, due to either technical and/or fundamental reasons, that the 10-Year Treasury Note yield should peak at 3.5%-4.0%. While their reasoning and analyses for such a conclusion seems reasonable – if not compelling – my analyses indicate that interest rates will climb to far higher levels, with the outsized adverse consequences I discussed in the aforementioned August 22 blog post. Much of the potential for rising interest rates will be due to the “bursting” of the bond bubble.

Many observers have dismissed the threat of rising interest rates, often for the reason that they believe a rising interest rate environment will be accompanied by a stronger economy; thus, by their reasoning, although there will be some sort of economic “drag” caused by rising interest rates, the “drag” will be largely, if not completely, offset by the concomitant strengthening economy.

For a variety of reasons, I do not believe this line of reasoning to be accurate. As I stated in the aforementioned August 22, 2013 post:

Although there are various areas which benefit from increased interest rates, from an “all-things-considered” basis rising interest rates have many problematic aspects for our current-era economy. While 10-Year Treasury Yields were above 5% as recently as 2007 – with no seeming adverse economic impact – I believe that the economy will have difficulties “absorbing” higher yields far before that 5%+ rate on the 10-Year Treasury is again reached.

Also, I do not believe that one should discount the adversity such a rising interest rate environment will have on the financial system, as well as (exceedingly) problematical aspects such a rising rate environment will have on various U.S. debt-funding and QE-related operations, such as that discussed in the June 26 post, “Potential Losses In The Federal Reserve’s Portfolio.”

As well, my analyses continue to indicate that another financial-system “crash” of tremendous magnitude will occur. In this “crash” I expect that 10-Year Treasuries will not be the “safe haven” many believe them to be.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1808.37 as this post is written