Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

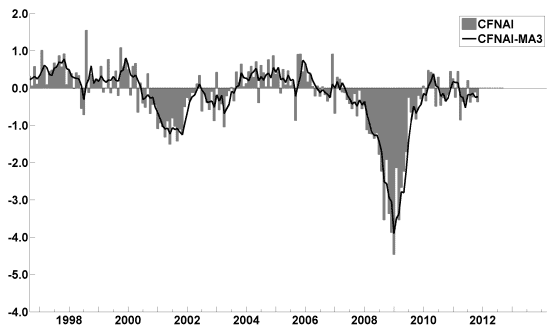

The December Chicago Fed National Activity Index (CFNAI)(pdf) updated as of December 22, 2011:

–

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the December 1 update titled “Index forecasts weaker growth” :

The November update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, increasing to 2.2% in November and December and then slowing to 1.6% in April. Persistent unemployment, elevated debt levels, high energy and food prices and low confidence have stalled consumer spending. Businesses are hesitant to expand amid uncertainty.

–

The ECRI WLI (Weekly Leading Index):

As of 12/9/11 the WLI was at 122.3 and the WLI, Gr. was at -7.5%.

A chart of the WLI Growth since 2000, from Doug Short’s blog of December 16 titled “ECRI Recession Call: Growth Index Contraction Moderates Fractionally” :

–

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of December 13 was at 42.0, as seen below:

–

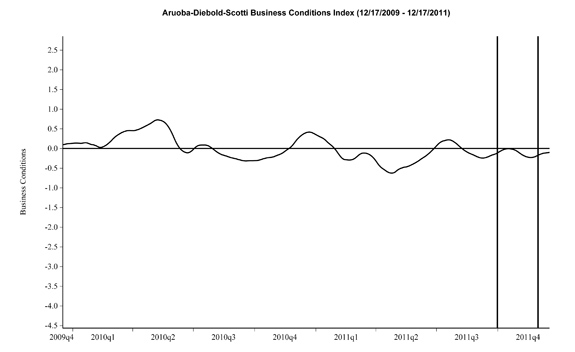

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 12-17-09 to 12-17-11:

–

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the December 22 release, the LEI was at 118 and the CEI was at 103.7 in November.

An excerpt from the December 22 release:

Says Ataman Ozyildirim, economist at The Conference Board: “November’s increase in the LEI for the U.S. was widespread among the leading indicators and continues to suggest that the risk of an economic downturn in the near term has receded. Interest rate spread and housing permits made the largest contributions to the LEI this month, overcoming a falling average workweek in manufacturing, which reversed its October gain. The CEI also rose on improving employment and personal income although industrial production fell in November.”

Says Ken Goldstein, economist at The Conference Board: “The LEI is pointing to continued growth this winter, possibly even gaining momentum by spring. For the second month in a row, building permits made a relatively strong contribution and there is a chance that the long decline in housing is finally slowing. However, this somewhat positive outlook for the domestic economy is at odds with a global economy that appears to be losing steam. In particular, a deeper-than-expected recession in Europe could easily derail the outlook for the U.S. economy.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1254.00 as this post is written

What about the Conference Board’s ration of coincident to lagging indexes? That is supposed to ‘lead’ and it’s not looking so good, yet I don’t see many including it in the debate.

http://www.bloomberg.com/apps/quote?ticker=RTCL:IND