For a variety of reasons, I believe the economic forecasts previous to and during the “Financial Crisis” of late ’08 – early ’09 deserve scrutiny. I have assembled a variety of the more notable forecasts and opinions of the period in a document titled “Predictions.”

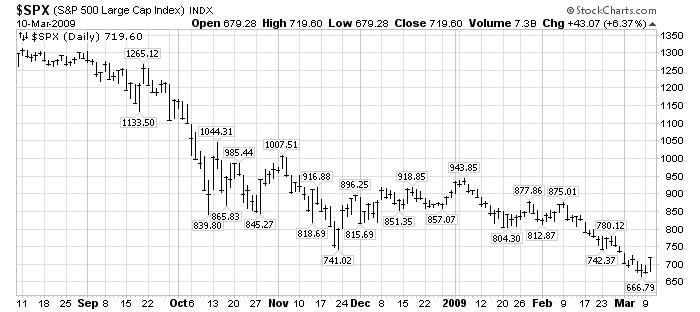

Additionally, I would like to highlight the August 2008 Wall Street Journal Economic Forecast Survey. This survey was conducted on August 8-August 11, 2008. At that point during 2008, there had been a variety of financial and economic problems that had surfaced; however, the stock market, as depicted by the S&P500, closed at 1296.32 on August 8, 2008. The chart below shows the price action from August 8, 2008-March 10, 2009. By March 10, the low of 666.79 had been reached two days before, as depicted:

(chart courtesy of StockCharts.com)(click on image to enlarge chart)

Here are various excerpts from the aforementioned Wall Street Journal Economic Forecast Survey, dated August 14, 2008:

- “Economists are deeply divided on whether or not we are in a recession, according to the latest WSJ forecasting survey.” 53% said Yes, while 47% said No.

- GDP, average expectation (among respondents) for year 2008, was seen at 1.2%; for year 2009, 1.9%.

- Unemployment, average expectation as of December 2008 was seen at 5.9%; for December 2009, 6%.

- CPI, average expectation, December 2008 was 4.1%; December 2009, 2.4%.

- Crude Oil, average expectation, for December 31, 2008, was $107.99/bbl; for June 30, 2009, $100.61/bbl.

The above illustrates the difficulties inherent in economic forecasting prior to and during a severe crisis. It should cast uncertainty on forecasters’ ability to predict future crises.

_____

A Special Note concerning our economic situation is found here

SPX at 1286.12 as this post is written